US

Canada

Passamaquoddy

|

Loading

|

"For much of the state of Maine, the environment is the economy" |

|

News Articles

about

Passamaquoddy Bay & LNG

2012 October

| 2016 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2015 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2014 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2013 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2012 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2011 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2010 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2009 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2008 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2007 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2006 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2005 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2003 – 2004 | |

2012 October 31 |

Nova Scotia

Partnerships key to Goldboro LNG success — Guysborough Journal, Guysborough, NS

In addition to the partnership with MODG that helped get the Goldboro LNG plans to this stage, Pieridae Energy has also established and is pursuing a number of private-sector partnerships. The federal government will also be involved in terms of the regulatory process.

During an interview with The Journal Sunday, Hines said the potential business partners that Pieridae is in talks with “are all significant partners across the globe.”

Webmaster's comment: Hines' remark resembles defunct-Quoddy Bay LNG president Don Smith's bloviating inaccuracies.

Goldboro LNG and the legacy of Kevin Dunn — Guysborough Journal, Guysborough, NS

The proponents of Goldboro LNG have “ a very focused window of opportunity,” he noted.

East Coast

US Northeast gas pipelines weather storm despite power outages (Oct 30) — Platts

In the aftermath of Hurricane Sandy, US natural gas pipelines and liquefied natural gas terminals seem to be faring well, despite some power and communication problems, officials said Tuesday.

Caribbean

LNG and future power generation — The Gleaner, Kingston, Jamaica, West Indies

The advantages of CNG include reduced pre-shipment preparation, no requirement for ultra-low-temperature liquefaction, thickly insulated transport vessels, and no need for regasification at its destination.

CNG is considered to have a clear advantage over LNG for delivery of modest-size quantities of gas over relatively short distances.

The International Energy Agency estimates that with proximity to sources of gas and relatively short transport distances, the supply cost of CNG would be one-half that of LNG.

Although the new generators are normally referred to as being designed for LNG as fuel, in reality they are designed to burn natural gas and will be operationally indifferent as to whether the gas was once liquefied or super-compressed.

British Columbia

Editorial: Pathways — Terrace-Standard, Terrace, BC

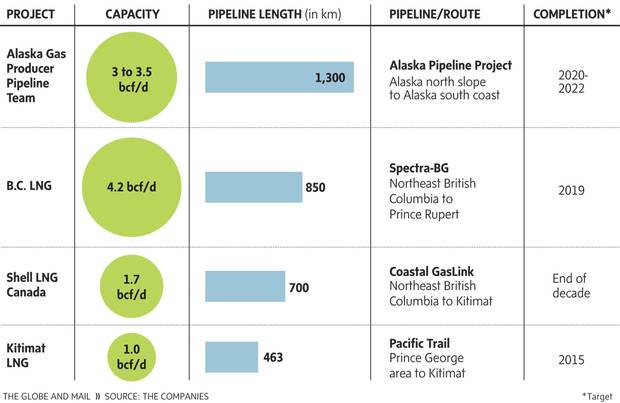

At last count, there are four pipelines planned to feed proposed liquefied natural gas (LNG) plants in Kitimat and in Prince Rupert and one oil pipeline.

Oregon

Court ruling a setback for Oregon pipeline — Natural Resource Report, OR

The Oregon Court of Appeals rejected a motion to force Clatsop County to allow Oregon LNG to build 41 miles of pipeline through the county. The pipeline would carry liquefied natural gas [sic; natural gas] to a proposed export terminal in Warrenton, near the mouth of the Columbia River.

U.S. Senators request more time for scoping comments on Oregon LNG export project — LNG Law Blog

Senators Ron Wyden (D-OR) and Jeff Merkley (D-OR) have requested that FERC extend the deadline for comments on the scope of FERC's environmental review of the Oregon LNG export terminal and related pipeline project from November 8, 2012 to January 8, 2013.

Numerous comments filed on scope of Environmental Review of Jordan Cove LNG export terminal — LNG Law Blog

Comments from a wide range of interested parties have been filed at FERC on the scope of its environmental review of the Jordan Cove Energy LNG export terminal and related pipeline project. Commenters include the State of Oregon, the U.S. Environmental Protection Agency, environmental groups, and various individuals.

United States

Gas boom means U.S. exports grow fastest rate since ’70s: Energy — Bloomberg

The natural gas glut that’s straining drillers is creating a bonanza for pipeline operators, spurring the biggest increase in exports to Mexico and Canada since the 1970s.

Exporting to neighboring countries allows pipeline companies and gas producers to reach new markets without the risk of the LNG trade, said Judith Dwarkin, chief energy economist at ITG Investment Research in Calgary.

The country will be a net exporter in about a decade, according to the department’s data. Imports from Canada have fallen to 8.2 billion cubic feet a day this year, from 10.4 billion in 2007. Imports from Mexico have fallen to less than 1 million cubic feet a day this year, from 148 million cubic feet a day in 2007.

Exports last year were driven by a 49 percent jump in shipments to Mexico and a 26 percent increase in shipments to Canada, according to the department.

U.S. producers in Pennsylvania’s Marcellus Shale have plenty of cheap gas and are closer to Canada’s big markets, said Martin King, an analyst with FirstEnergy Capital Corp. in Calgary.

About one-third of the planned exports will come from reversing or expanding existing border crossings. [Red, yellow & bold emphasis added.]

Webmaster's comment: Goldboro LNG in eastern Nova Scotia plans on receiving one-third of its natural gas from the US — by reversing the flow of the Maritimes & Northeast Pipeline.

Downeast LNG has no more substance than a Haloween phantom.

2012 October 30 |

Passamaquoddy Bay

LNG: Ooops! Downeast LNG stumbles again. (Oct 25) — The Bay of Fundy Explorer

Downeast LNG has obviously and carelessly pasted boilerplate text from a completely unrelated LNG project into its response to FERC. The EcoEléctrica LNG terminal near Peñuelas, Puerto Rico, is very different from the proposed Downeast LNG terminal in Robbinston, Maine. The settings and safety issues are different. [Red & bold emphasis added.]

Maine

Presque Isle hospital first in state to convert to compressed natural gas (Oct 27) — Bangor Daily News, Bangor, ME

XNG will be the first company in Maine to haul CNG for heating use, and will provide the trailers, decompression station, CNG, and do all of the hauling. The hospital’s supply of CNG will come from the northeastern United States. XNG trucks with tube trailers will transport the fuel from a new CNG compression station being built in Baileyville in Washington County. [Red, yellow & bold emphasis added.]

Webmaster's comment: There is no shortage of natural gas in Maine, New England, the Northeast, or the US. Downeast LNG is hallucinating.

MaineGeneral signs 10-year deal with Maine Natural Gas for new hospital heating — Kennebec Journal, Augusta, ME

Hays said the hospital had originally planned to use a liquefied natural gas system, but piped-in gas is estimated to save more than $250,000 in infrastructure costs.

Brunswick-based Maine Natural Gas already has state Public Utilities Commission approval to distribute gas anywhere in Maine where a gas pipeline does not already exist.

Canada

Exxon favors gas over expensive oil sands in M&A deals — Bloomberg Businessweek

Three of the five largest energy acquisitions announced by foreign buyers in Canada this year, valued at a combined $9.8 billion, were for natural gas assets, according to data compiled by Bloomberg. The trend will continue next year as liquefied natural gas developers move closer to commissioning projects, said Robert Mark, who helps oversee C$4.5 billion ($4.5 billion) at MacDougall, MacDougall & MacTier Inc. in Montreal.

2012 October 29 |

Nova Scotia

LNG plan gives hope to Goldboro families (Oct 25) — The Chronicle Herald, Halifax, NS

“[Y]ou can’t blame people for getting their hopes up. But we’ve seen a number of proposed megaprojects go down and people are cautious with their optimism. It’s like the boy who cried wolf.”

“It’s not just a local thing. Seeking these big projects is like prospecting for gold. We should invite them, by all means, to make proposals and try, but we should avoid getting our hopes up.”

Caribbean

Trinidad and Tobago Energy Minister outlines LNG export changes — Oil & Gas Journal [Subscription]

Trinidad and Tobago, a major LNG exporter in the Western Hemisphere, is changing its emphasis from spot sales to large Atlantic Basin customers to contracts with Caribbean and South American nations eager to move to gas from imported diesel and fuel oil for electricity generation, the country's energy minister said. "We like to think of ourselves as the Atlantic Basin's LNG pioneer," Kevin C. Ramnarine told an American Gas Association Natural Gas Roundtable breakfast. "But there's no escaping the possibility that the United States, with its considerable shale gas resources, could become the region's LNG export leader if it decides to." He noted that as recently as 3 ye... [Red & bold emphasis added.]

Alaska

Southcentral utilities plan to import gas to meet projected shortfall — Alaska Journal of Commerce, Anchorage, AK

Gas fields in the region, which date from the 1960s, are being depleted, and production will be inadequate to meet local demand for space heating and power generation by as soon as 2014, said Lee Thibert, vice president for strategic planning for Chugach Electric Association, the state’s largest electric utility.

The group has also been in discussions with ConocoPhillips on converting its LNG plant at Kenai to a regasification and import facility. The plant is still making LNG and shipping it to Japan, but the LNG export license for the plant expires next March.

Webmaster's comment: This is an example of how the free market can sometimes backfire on public interests, in favor of big business; short-term big business profits vs. long-term energy security. The Federal Government has allowed Southcentral Alaskan natural gas to be shipped to Asia since 1969. Now, the area gas supply is nearly exhausted, so Southcentral Alaskans now may have to import LNG, or freeze.

Utilities move forward on two options for gas imports (Oct 27) — Anchorage Daily News, Anchorage, AK

With natural gas supplies from Cook Inlet set to fall short of local gas demand by 2014 or 2015, the time has come to start arranging imports to supplement that gas, Southcentral utility executives told the Regulatory Commission of Alaska last week.

Opening of huge Russian field drives another nail into Alaska's gas coffin (Oct 28) — Alaska Dispatch, Anchorage, AK

[W]ith Bovanenkovo coming online in Russia's Arctic, floating LNG production platforms starting to be employed offshore in the Asia-Pacific region, and continuing plans in the Lower 48 and Canada to ship shale gas via LNG tankers to foreign markets, one has to wonder if Alaska's gas reserves will get to any market anytime soon.

British Columbia

Pipeline sea route possible — Terrace Standard, Terrace, BC

The final leg of a planned natural gas pipeline from northeastern B.C. to Prince Rupert could very well go underwater.

One of the water routes would have the pipeline enter the ocean in the Kitsault area and the other in the Nasoga Gulf area, just north of the Khutzeymateen grizzly bear sanctuary. The land route would run south of the Nasoga route.

Project comes out of its shell — Terrace Standard, Terrace, BC

Details of one of the pipeline projects to supply a planned liquefied natural gas (LNG) plant at Kitimat emerged last week as officials from Coastal GasLink held public sessions and met with local government officials.

The TransCanada Corporation pipeline would run 700km from gas fields in northeastern B.C. to an LNG plant, called Canada LNG that is owned 40 per cent by Shell Canada with state-owned Korea Gas, state-owned Petro-China Company and Mitsubishi each taking 20 per cent.

At 48 inches in diameter, the pipeline would deliver at least 1.7 billion cubic feet of gas a day to the Canada LNG plant which, based on two processing units, is scheduled to initially export as much as 12 billion tonnes of LNG a year.

United States

The elusive promise of cheap energy — DC Bureau, Washington, DC

...Today domestic gas supplies are so high and prices so low that energy companies are scrambling for clearance to export it to countries that will pay three or four times as much for it.

But granting export permits to all who seek them could be a dangerous mistake. The U.S. Department of Energy, among others, suspects that rampant exporting would trigger domestic price spikes that would hurt consumers, electric utilities and manufacturers. Over time, more expensive gas would undercut the competitiveness of U.S. manufacturing worldwide.

The problem is that energy company applicants seek clearance to export a total of 48 billion cubic feet of gas a day – well over half of all U.S. gas consumption. A preliminary study by the DOE found the export of 12 bcf per day would raise prices as much as 9 percent. Cheniere is authorized to export up to 2.2 bcf per day from Sabine Pass.

Apache Corp. and Royal Dutch Shell have already announced plans to ship LNG to Asia from the town of Kitimat on Canada’s Pacific Coast. On Canada’s Atlantic Coast, Pieridae Energy Canada plans exports to Europe and India from a site north of Halifax, Nova Scotia.

“Currently every major pipeline is looking for ways to bring Marcellus gas to Canada,” Alfred Sorensen, president of Pieridae, told DCBureau.org. “Once the gas crosses the border it is no longer ‘U.S. gas’ and is not subject to the U.S. restrictions currently in place.” [Red & bold emphasis added.]

Qatar seeks US foothold to sustain LNG dominance — Gulf Times, Doha, Qatar

Qatari producers are looking abroad as a moratorium limits domestic expansion and amid a boom in new projects from the US to Australia. The increased volume may help offset lower income as users from Tokyo Gas Co to Italy’s Edison seek to reduce costs under supply contracts linked to crude prices.

“The government has temporarily taken away the ability to expand production in Qatar,” Trevor Sikorski, director of European energy markets research at Barclays in London, said on October 4 by phone. “If you are facing price risk, you have to do something on volume.”

Mexico

16th Annual Mexican Energy — Platts

New Perspectives on Energy Policy and Gas Supply for Economic Growth

[This is a conference announcement.]

2012 October 26 |

Nova Scotia

Canadian group opens new front in North American LNG export race — ICIS Heren, England, UK

"We have more interest than capacity," Pieridae CEO Alfred Sorensen said. "We're going to work very hard between now and Q1 [2013] on the contractual [agreements]." ....

While western Canadian export projects are under development in British Columbia, Indian state-owned network operator GAIL previously told ICIS in April that the shipping costs from western Canada were prohibitive, and instead was considering options on North America's coast (see GLM 27 April 2012).

The project intends to draw upon offshore natural gas pipelines that make landfall in Nova Scotia, which include the Sable and Deep Panuke subsea pipelines, as well as tap into the Maritimes and Northeast pipeline systems that link to the northeastern US and run across the project site in Goldboro.

Canadian LNG exports — Energy & Capital

Nova Scotia Facility to Sell LNG Internationally

On Wednesday, our northern neighbor announced plans for a new LNG facility in Goldboro, Nova Scotia.

LNG expert dismisses Goldboro export plant as long shot (Oct 25) — CBC News

[This same article appears under the New Brunswick heading, below.]

Shook does not believe Pieridae would be able to use shale gas from the United States under the North American Free Trade Agreement (NAFTA).

The company could import the gas into Canada, but would not be able to export it to a non-NAFTA country without a special exclusion permit, which is difficult to obtain, she said.

The president of the Atlantica Centre for Energy contends Canaport LNG's import terminal in Saint John would make a better location, due to existing infrastructure and proximity to natural gas sources in the United States.

People interested in buying Spanish oil giant Repsol's 75 per cent-share of Canaport, which is co-owned by Irving Oil Ltd., have been visiting the site in recent weeks, said Herron.

He believes the potential buyers are primarily interested in converting Canaport into an export terminal. [Red, yellow & bold emphasis added.]

Taylor: Don’t count your LNG plants before they’re built [Opinion] (Oct 25) — The Chronicle Herald, Halifax, NS

[I]t has been more than 2½ years since a dream to build a $4-billion petrochemical plant in Goldboro was abandoned by a group that had been pushing the idea for the better part of a decade. The proposed site of the liquefied natural gas export facility is on the same site proposed for the petrochemical plant.

There is no indication ... that the LNG project will be any more successful this time than the previous petrochemical facility — except perhaps for the fact that the group pushing the idea, Pieridae Energy Canada, has had experience building a similar operation in Kitimat, B.C.

It also doesn’t seem to make sense that the Maritimes would have an LNG importing facility in Saint John, N.B., and an exporting facility in Goldboro.

So why doesn’t Pieridae simply buy and convert the Canaport LNG facility in Saint John? [Red & bold emphasis added.]

Webmaster's comment: There is no accounting for some LNG industry players' logic. Just take a look at Downeast LNG, still proposing an LNG import terminal when the industry universally indicates that it is not needed.

Dexter cautiously optimistic about planned LNG facility for Goldboro (Oct 24) — The Chronicle Herald, Halifax, NS

“Over the last two or three years ... we’ve had, really, a number of prospective developers around the question of natural gas exports,” [Nova Scotia Premier Darrell Dexter] said.

Goldboro LNG terminal would use existing Maritime pipeline (Oct 24) — The Globe and Mail, Toronto, ON

[An] LNG facility proposed for Nova Scotia would be located next to the Maritimes & Northeast Pipeline, a 1,400-kilometre system that carries natural gas to Nova Scotia, New Brunswick and New England.

New LNG plant proposed to open in Goldboro (Oct 24) — CBC News

Company President Alfred Sorenson estimates 33 per cent of the gas will come from the U.S., another 33 per cent from onshore gas in Eastern Canada and the rest from offshore.

Sorenson said he believes the project will succeed over previous efforts because this is an export, not import, facility. [Red & bold emphasis added.]

Canadian group plans East Coast LNG export plant (Oct 24) — Reuters Canada

The site on the southeast coast of Nova Scotia is adjacent to the Maritimes & Northeast Pipeline, which carries gas to Atlantic Canada and the northeastern United States from the Sable offshore gas project operated by Exxon Mobil Corp.

Gas from Encana Corp's Deep Panuke natural gas project, which is expected to start up later this year, will also come ashore at the site in the community of Goldboro.

New Brunswick

Shale gas produces fractured lines in New Brunswick — Financial Post, Don Mills, ON

While some analysts have dismissed New Brunswick’s potential as an oil and gas hub, two reports last week once again brought the issue of shale gas development to the forefront.

“While there is a belief that New Brunswick does possess large scale shale gas deposits, the potential still needs to be calibrated through more exploration and testing,” Mr. LaPierre wrote in the report. “A moratorium will only serve to delay that important study and postpone making a determination if there is a business case for shale gas extraction, how it can be done on an environmentally sound basis, and how proposed regulations can be implemented to have the desired effect.”

Spanish giant Repsol SA., which operates the LNG import terminal in Saint John, is reportedly looking to sell its stake and has at least six players — from China, Spain, the United Kingdom, Russia and France — interested in the asset.

LNG expert dismisses Goldboro export plant as long shot (Oct 25) — CBC News

[This same article appears under the Nova Scotia heading, above.]

Shook does not believe Pieridae would be able to use shale gas from the United States under the North American Free Trade Agreement (NAFTA).

The company could import the gas into Canada, but would not be able to export it to a non-NAFTA country without a special exclusion permit, which is difficult to obtain, she said.

The president of the Atlantica Centre for Energy contends Canaport LNG's import terminal in Saint John would make a better location, due to existing infrastructure and proximity to natural gas sources in the United States.

People interested in buying Spanish oil giant Repsol's 75 per cent-share of Canaport, which is co-owned by Irving Oil Ltd., have been visiting the site in recent weeks, said Herron.

He believes the potential buyers are primarily interested in converting Canaport into an export terminal. [Red, yellow & bold emphasis added.]

Passamaquoddy Bay

Judge rules Quoddy Bay LNG lease invalid — The Quoddy Tides, Eastport, ME

US Department of Interior (DOI) Interior Board of Indian Appeals (IBIA) Law Judge Deborah Luther ruled on October 4 that a 2005 lease agreement between the Pleasant Point tribal government and now defunct Quoddy Bay LNG was invalid from the start. The Bureau of Indian Affairs (BIA) violated its own regulations, so the lease "never went into effect as a matter of law.," the judge ruled.

...Passamaquoddy tribal member and NN organizer Vera Frances states, "We are pleased with this closure, and know now what we knew then — that the ground lease was always invalid. But what we need to do today is to move on and close this chapter with grace and deep appreciation for that which has always sustained us — Passamaquoddy Bay." [Red, yellow & bold emphasis added.]

Northeast

Dominion, shipper cancel agreement for Cove Point LNG output (Oct 25) — Bloomberg Businessweek

Dominion Resources Inc. (D) said it and an unnamed shipping company terminated an agreement for liquefied natural gas to be processed and shipped from the company’s planned Cove Point export facility.

Dominion is in talks with other potential customers and expects to complete agreements for the terminal’s planned capacity by the end of the year, Dan Donovan, a spokesman for Dominion Energy, said in a telephone interview today. [Red emphasis added.]

Gulf of Mexico

Company to build $2 billion natural gas plant in Port Lavaca — Victoria Advocate, Victoria, TX

Excelerate Energy has announced it will build a liquefied natural gas terminal in Port Lavaca in its bid to become one of the first American energy companies to export natural gas.

"Port Lavaca provides us with the unique opportunity to further capitalize on our position as a market leader in floating LNG (liquefied natural gas) solutions," said Rob Bryngelson, Excelerate Energy president and CEO.

Cheniere considers 50% expansion of LNG plant at Sabine Pass (Oct 25) — Bloomberg Businessweek

Cheniere Energy Inc., the first company to win approval to export gas from the continental U.S., is considering a 50 percent expansion of capacity at its Sabine Pass terminal in Louisiana as LNG demand rises.

“When we marketed the project at Sabine Pass, clearly we had more demand than we could satisfy,” Nicolas Zanen, the vice president of trading at Cheniere, said in an interview in Singapore today. “It makes sense to look at expanding to a fifth and a sixth” train for liquefying gas, he said. No timeline for enlarging the facility has been set, he said.

“Customers come to us and say they want to buy LNG from the U.S., they want to buy based on Henry Hub,” Zanen said. “We have a good idea of what the demand is like. The U.S. gas price is very cheap, and they want to benefit from that. They want to diversify as well.”

Webmaster's comment: Cheniere's fire-sale pricing is already building demand for more, even before the LNG is available. What will this do to US natural gas prices?

Alaska

Southern Alaska utilities seek proposals for gas deliveries (Oct 25) — Platts

The group has also been in discussions with ConocoPhillips on converting its LNG export plant at Kenai to a regasification and import facility. The plant is still making LNG and shipping it to Japan, but the LNG export license for the plant expires next March.

[Lee Thibert, vice president for strategic planning for Chugach Electric Association,] said the LNG options being considered include conventional ships like those now carrying LNG from the Kenai plant, LNG vessels with ship-mounted regasification, and LNG barges that would be towed by tugs.

US Senator Lisa Murkowski discusses Alaskan LNG with producers (Oct 25) — LNG World News

Murkowski said it’s important that Alaska price its gas competitively in the world market to ensure development of a project that’s estimated to cost as much as $65 billion. But she also pressed the executives of all three companies on the importance of moving quickly to seize the opportunity to ship Alaska gas to the energy hungry markets of Japan, South Korea and the rest of the Pacific Rim.

Oregon

In our view: LNG proposal suffers setback [Editorial] — The Columbian, Vancouver, WA

Another defeat was suffered this week by proponents of liquefied natural gas pipelines near the Columbia River estuary. Think of it also as another triumph for nature, and for the countless people of this region who properly believe the lower Columbia River must be protected from incursions by the petroleum industry. The Oregon Court of Appeals ruled on Wednesday that Clatsop County (Astoria) commissioners were correct in March 2011 when they denied an application by Oregon LNG to build a pipeline from a proposed LNG plant on the Skipanon River near Warrenton.

LNG tanker safety In Columbia River sparks appeal — Oregon Public Broadcasting, OR

The lawsuit challenges the U.S. Coast Guard’s green light for the proposed Oregon LNG terminal and associated LNG tanker traffic.

Following a lengthy administrative appeal process, the citizens’ groups filed a lawsuit in the Ninth Circuit Court of Appeals challenging the Coast Guard’s decision to issue its recommendation before preparing an Environmental Impact Statement and considering the impacts on endangered species. The challenge contends that the U.S. Coast Guard violated the National Environmental Policy Act, which requires a thorough analysis of the impacts, and the Endangered Species Act, which requires the Coast Guard to consult with fisheries agencies.

Webmaster's comment: This lawsuit could also impact the Downeast LNG project.

Court rules county can deny LNG pipeline (Oct 25) — The Daily Astorian, Astoria, OR

The Oregon Court of Appeals has paved the way for Clatsop County to finalize its denial of the proposed pipeline for liquefied natural gas.

This case began in March 2011, when the Clatsop County Commissioners voted 4-1 to deny the Oregon LNG pipeline application, saying the project does not comply with county law. The commission reversed the 2010 vote by a different board of commissioners.

Oregon LNG responded by filing a motion in Clatsop County Circuit Court, hoping to pre-empt the board’s decision. Oregon LNG argued that commissioners had already made an irreversible decision. But the Circuit Court rejected that challenge. Oregon LNG appealed the decision to the Court of Appeals.

Court rules against Clatsop gas pipeline (Oct 25) — Gazette-Times, Corvallis, OR

The Oregon Court of Appeals says Clatsop County can change its mind and block a pipeline that would carry natural gas to an LNG terminal at the mouth of the Columbia River.

The Oregonian reports the court's ruling Wednesday paves the way for the county to make final its decision against zoning for the Oregon LNG terminal at Warrenton.

Local opposition led backers to drop plans for another LNG terminal, upriver from Astoria, in 2010. [Red & bold emphasis added.]

Ore. court rules against Clatsop gas pipeline (Oct 25) — (AP) Ventura County Star, Camarillo, CA

Three LNG terminals have been proposed in Oregon.

Local opposition led backers to drop plans for another LNG terminal, upriver from Astoria, in 2010.

A third terminal project, at Coos Bay, remains active.

Originally, the terminals were envisioned as a means to import liquefied gas, but technological advances touched off a boom in domestic exploration and production. After that, the LNG proposals began to focus on exporting domestic supplies to Asia.

United States

Qatar plans to build LNG plants in the United States [Times of Oman] (Oct 25) — equities.com

DOHA: Qatar is seeking to build liquefied natural gas (LNG) export plants in the United States to offset an anticipated slide in revenue as prices of the fuel fell from a record.

"The government has temporarily taken away the ability to expand production in Qatar, and if the question is growth and profit, it's not going to come from domestic production," Trevor Sikorski, director of European energy markets research at Barclays in London, said on October 4 by phone. "If you are facing price risk, you have to do something on volume."

2012 October 24 |

Nova Scotia

Multibillion-dollar LNG export facility announced — The Chronicle Herald, Halifax, NS

Pieridae Energy Canada is headed by energy trader Alfred Sorenen, who spearheaded a similar effort in Kitimat, B.C. through Galveston LNG Inc. that was later purchased Apache Corp. and EOG Resources for just over $300 million.

Sorensen said the difference between the previous plans by Celtic Petrochemicals and his company’s plan, has been the sudden surplus of onshore natural gas in northeastern North America created by the expansion of hydraulic fracturing technology.

“People didn’t see it coming,” said Sorensen.

“Goldboro provides an excellent location for exports and will be the east coast of Canada and the United States’ closest mainland LNG export terminal to Europe and India,” Sorensen said. [Red & bold emphasis added.]

Webmaster's comment: Downeast LNG still doesn't see that it is already here.

Liquefied natural gas development proposed for eastern Nova Scotia — (Canadian Press) 680News, Toronto, ON

The president of Pieridae Energy Canada said Wednesday he is looking for sources of gas that will be cooled, liquefied and exported by ship from the Guysborough County community of Goldboro, about 200 kilometres northeast of Halifax.

Sorensen, who is also the CEO of Calgary-based energy firm Canadian Spirit Resources Inc. (TSX:SPI.V), said he has two investors involved as backers though he declined to identify them. He said he plans to create a Nova Scotia office in January.

"It's the exact opposite from what was originally planned here," he told a news conference in Goldboro.

"We have no imminent plans to reverse our pipeline," [Maritimes and Northeast Pipeline spokesman Steve Rankin] said. "We have received numerous inquiries from existing and potential customers to look at scenarios that would involve reversal of the pipeline both for future service of the Canadian market and for a potential export of LNG." [Red & bold emphasis added.]

$5 billion LNG facility announced for Goldboro — Guysborough Journal, Guysborough, NS

GUYSBOROUGH -- GOLDBORO -- Guysborough County may soon be North America’s gateway for the export of liquefied natural gas (LNG) to markets around the world. Pieridae Energy Canada announced plans for a $5 billion LNG export facility at Goldboro today (Wednesday) in both Goldboro and Halifax. The development will be located within the Municipality of the District of Guysborough (MODG) Goldboro Industrial Park.

“Goldboro LNG will connect the expanding supply of natural gas in both Canada and the United States with the increasing global demand,” said Sorensen in a company release. “With our location and proximity to existing gas pipeline infrastructure, Goldboro LNG is well positioned as the gateway to the global markets for North American LNG.”

Sorensen told The Journal the plan is to secure a gas supply from offshore NS, onshore in both NS and NB, and possibly some from the U.S. [Red & bold emphasis added.]

Pieridae Energy proposes $5 billion East Coast LNG facility — Alberta Oil, AB

The plan, which Sorensen said will be submitted for environmental review in the first quarter of 2013, hinges on reversing the flow on the Spectra Energy-owned Maritimes & Northeast pipeline, which was built in the late 1990s to deliver production from offshore gas fields in Nova Scotia to New England and Atlantic Canada.

Sorensen, who is Pieridae’s president, said a reversed Maritimes pipeline could deliver up to 700 million cubic feet of gas per day to the terminal for export. Much of that is likely to come initially from the Marcellus shale in Pennsylvania, Sorensen said.

“Plus you’ve got this gas bubble in the northeast U.S. building with the Marcellus and potentially with New Brunswick gas. You’ve got the ability to tap into very large resources that are close by.” [Red & bold emphasis added.]

LNG terminal proposed for eastern Nova Scotia — The Globe and Mail, Toronto, ON

Canada’s East coast may soon be a major hub of cross-Atlantic liquefied natural gas exports.

Energy entrepreneur Alfred Sorensen is proposing to build a giant LNG export facility in Goldboro, N.S., producing about 5 million tonnes per year and on-site storage capacity of 420,000 cubic metres.

Mr. Tertzakian also said sourcing enough natural gas from Canadian producers on the East Coast might prove difficult because of lack of availability. If most of the supply were to come from the massive Marcellus shale in Pennsylvania, then the new Nova Scotia terminal would just act as a transit facility for U.S. producers, he added.

[R]oughly one-third of the supply would come from Marcellus, he added. [Red & bold emphasis added.]

Company proposes liquefied natural gas project for eastern Nova Scotia — Lethbridge Herald, Lethbridge, AB

The president of Pieridae Energy Canada says he is looking for sources of gas to be liquefied and exported from the Guysborough County community of Goldboro, about 200 kilometres northeast of Halifax. [Red & bold emphasis added.]

Contact Exploration announces negotiations for New Brunswick natural gas assets — (Canadian Newswire) equities.com

As announced by Pieridae, the Goldboro LNG Facility is to include a gas liquefaction plant and facilities for the storage and export of LNG, including a marine jetty for off-loading, and upon completion, is expected to ship approximately five million metric tons of LNG per year and have on-site storage capacity of 420,000 cubic metres of LNG. The Goldboro LNG Facility is to be located adjacent to the Maritimes & Northeast Pipeline, a 1,400-kilometre transmission pipeline system built to transport natural gas between Nova Scotia, Atlantic Canada and the North eastern United States.... [Red & bold emphasis added.]

LNG plant set for Goldboro (Oct 23) — The Chronicle Herald, Halifax, NS

A multibillion-dollar liquefied natural gas export terminal is being floated for Goldboro.

The proponents of the Guysborough County plant proposed a similar project in Kitimat, B.C., and then sold it once they had the approvals in place to build the facility, said the source.

“They’re doing the same thing here in Goldboro.”

Plans for the plant would involve reversing the gas flow in the Maritimes & Northeast pipeline, which stretches from Goldboro to Dracut, Mass.

Shale gas from New York and Pennsylvania could be piped via that route to Goldboro, liquefied and shipped out of the country, said the source. Gas from offshore Nova Scotia could also wind up being liquefied at the plant. [Red & bold emphasis added.]

Webmaster's comment: This demonstrates how incorrect Downeast LNG president Dean Girdis has been in his proposed import terminal.

Taylor: Hopeful signs in energy sector — The Chronicle Herald, Halifax, NS

Encana management has been cagey about when gas production will be coming from Deep Panuke. Possibly the last conventional gas project on its books, Encana has been slow to bring Deep Panuke into production, pushing back the startup several times since announcing in 2007 it would proceed with its development.

The fact that Encana is about to start production of the Deep Panuke project just as ExxonMobil’s Sable project is winding down seems to create a logical fit.

Gulf of Mexico

Trinidad and Tobago energy minister outlines LNG export changes — Oil & Gas Journal

Trinidad and Tobago, a major LNG exporter in the Western Hemisphere, is changing its emphasis from spot sales to large Atlantic Basin customers to contracts with Caribbean and South American nations eager to move to gas from imported diesel and fuel oil for electricity generation, the country’s energy minister said.

He noted that as recently as 3 years ago, 80% of Trinidad’s LNG cargoes went to US customers and the other 20% elsewhere. “That has flipped because of this country’s shale gas revolution, and we expect US demand for our LNG to eventually fall to zero,” Ramnarine said. [Red & bold emphasis added.]

BP disagrees with Energy Minister on US$120m claim — The Trinidad Guardian Newspaper, Port-of-Spain, Trinidad and Tobago, West Indies

Energy giant BP yesterday said that the “implications of impropriety in BP LNG sales reported in recent media articles are incorrect.” The company was responding to last week’s statement by Energy Minister Kevin Ramnarine that T&T lost an estimated US$120 million ($771 million) between 2009 and 2012 because state-owned National Gas Company’s (NGC) equity gas from Train IV was marketed by BP in that period.

United States

The big new push to export America’s gas bounty(Oct 23) — The New York Times, New York, NY

[Excelerate Energy] plans to build a multibillion-dollar offshore export terminal halfway between Corpus Christi and Galveston to ship natural gas around the world.

With 15 other export projects currently under review by the Energy Department, America could soon become the world’s second-largest natural gas exporter behind Russia, which remains the largest seller because of its long-term contracts to energy buyers across Europe and farther afield.

The glut puts the United States at the center of the increasingly globalized natural gas market.

In early October, Golden Pass Products, a venture whose majority owner is the state-owned Qatar Petroleum International, was granted a license to export liquefied natural gas from a proposed site in Texas. The British energy company BG Group, which owns shale gas deposits from Texas to New York, also plans to ship American natural gas from its operations in Louisiana. [Red, yellow & bold emphasis added.]

2012 October 23 |

Gulf of Mexico

The big new push to export America’s gas bounty — The New York Times, New York, NY

[This same article appears under the United States heading, below.]

The Houston energy company [Excelerate Energy] plans to build a multibillion-dollar offshore export terminal halfway between Corpus Christi and Galveston to ship natural gas around the world.

“Asian companies are out in front in signing natural gas contracts,” said Teri Viswanath, a commodity strategist at the French bank BNP Paribas in New York. “For countries like China, the tremendous domestic demand ensures it will always be an importer.”

Webmaster's comment: Teri Viswanath's opinion that Chila will always be a natural gas importer may or may not be true. China is a vast country with its own vast shale gas assets that it has not yet developed.

Oregon

LNG tanker safety sparks appeal — The Daily Astorian, Astoria, OR

Federal law requires the Coast Guard to issue a letter of recommendation on the suitability of the Columbia River for LNG tanker traffic as it relates to safety and security. In 2009, the Coast Guard issued its determination, finding that the Columbia River is not currently suitable for LNG traffic, but could be made suitable.

Following a lengthy administrative appeal process, the citizens’ groups filed a lawsuit in the Ninth Circuit Court of Appeals challenging the Coast Guard’s decision to issue its recommendation before preparing an Environmental Impact Statement and considering the impacts on endangered species. The challenge contends that the U.S. Coast Guard violated the National Environmental Policy Act, which requires a thorough analysis of the impacts, and the Endangered Species Act, which requires the Coast Guard to consult with fisheries agencies.

“The Coast Guard failed to comply with the law when it gave the OK for LNG traffic. They failed to consider the new threat of export, failed to engage stakeholders, and failed to take a hard look at the impacts as required by federal law,” stated Brett VandenHeuvel, executive director for Columbia Riverkeeper.

Webmaster's comment: According to the US Coast Guard Captain of the Port staff in South Portland, Maine, the Coast Guard is no longer required to consider NEPA (National Environmental Policy Act) when rendering its Waterway Suitability decisions.

Hawaii

Environmental groups: Don't import natural gas — Honolulu Civil Beat, Honolulu, HI

Hawaii has the highest dependency on fossil fuels of any state, according to the Hawaii Clean Energy Initiative website. Hawaii residents also pay more for electricity than almost anyone else in the nation.

LNG is seen by many as an inexpensive alternative to oil and the proposal has the support of the Abercrombie administration. State officials have said that even when shipping costs are factored in, consumers would save money with natural gas.

"Until we find a way to store energy from renewable energy we’re always going to need a source of firm energy to back it up," said Boivin, adding that natural-gas fired power plants fill that need.

"Liquefied natural gas is a very greenhouse gas-intensive fuel because of all of the energy it takes to drill, liquefy, transport and re-gasify it," said Ellen Medlin, an attorney at the Sierra Club who helped draft the organization's motion to intervene in the gas company's application. [Brown & bold emphasis added.]

Webmaster's comment: Hawaii has plentiful, renewable, clean geothermal energy to generate electricity at its disposal, with no storage requirements. It is surprising the state is considering LNG imports.

Canada

Petronas-Progress saga all about protecting turf [Opinion] — The Globe and Mail, Toronto, ON

[T]he real antagonist derailing Petronas was, in part, the well-timed ExxonMobil-Celtic deal.

There are many valid issues associated with state-owned enterprises that don’t sit well with Canadian interests. Poor human rights records, corruption, a dearth of democracy and fear of cultural misalignment are just a few. All are good fodder for late-night debate over a Scotch as Canadians and the federal government stumble to figure out what the ownership characteristics of our natural resources should look like in a brutally competitive world.

Even if the Petronas-Progress deal comes to life again, last week’s surprise rejection will surely serve to hose down the enthusiasm of state-owned players seeking entry into the fray. As a consequence, the cost of doing business in Canada’s oil and gas industry has just gone down – an outcome that is advantageous for the large domestic incumbents. Yet, it’s far less clear that this protection of competitive turf and cheapening of assets is advantageous to the interests of Canada.

United States

Building gas power plants: Investment or speculation? — Platts

While discussing the challenging outlook for financing new power plants during a recent conference in New York, Carl Williams, a principal at Riverstone Holdings, harkened back to 1998-2001 when a sudden surge in building new generation fired by natural gas resulted in the addition of 70 GW to the grid. But rather than scaling back, developers – and the bankers who funded them – continued the build-out, adding another 105 GW between 2001 and 2003, the equivalent of replacing the entire capacity of the PJM Interconnection, Williams noted.

The result was a glut of gas-fired generation that is still being sorted out through multiple bankruptcies and serial mergers and acquisitions.

Williams, speaking at Platts 14th annual Financing US Power conference in New York on October 19, expressed a concern that once again, “we could be escalating commitment to a failing action.”

Then, as now, there is an “overriding belief in market constructs,” Napolitano said. The flaw with market constructs, he said, is that “when things are going fine, you can depend on them; when they aren’t, you can’t.”

“I believe we will do exactly the same thing again,” Williams said, referring to the last gas-plant build-out. “The herd mentality will be difficult to break.” [Red, yellow & bold emphasis added.]

Webmaster's comment: "Herd mentality" is exactly what occurred with the lemming-like rush to build LNG import terminals, and is what is now occurring to build LNG export terminals. Both are/were "escalating commitments to failing actions."

Explain ground rules for natgas export decision -Sen. Wyden — Reuters

The U.S. Energy Department needs to explain how it will determine whether to allow more exports of the nation's bountiful supplies of natural gas, Senator Ron Wyden, a top Democrat on the Senate Energy Committee, said on Tuesday.

"I request an all-inclusive description of the factors that DOE will consider in determining whether to approve a supplier's authority to export LNG, and what factors DOE will consider in revoking such authority," Wyden wrote in a letter he sent Chu on Tuesday.

The United States has been flooded with natural gas thanks to horizontal drilling and hydraulic fracturing, or "fracking," technology that has helped drillers tap supplies trapped in shale rock formations. [Red & bold emphasis added.]

Key US lawmaker wants answers about potential LNG exports — Platts

Wyden said DOE should consider a host of factors in deciding whether to approve would-be LNG exports, including the impact they would have on US natural gas supplies and commodity prices. DOE should also consider how LNG exports would affect US air pollution levels, electricity prices, employment, manufacturing and economic growth, Wyden said. [Red & bold emphasis added.]

Critic: Shale gas a false hope — UPI

Food & Water Watch announced it opposed energy industry efforts to tout the benefits of liquefied natural gas and hydraulic fracturing.

The group said any effort to expand the use of LNG for exports would lead to more hydraulic fracturing, known also as fracking. More LNG production, they said, means more environmental threats.

Analysis of deep monitoring wells by the Environmental Protection Agency in a Wyoming aquifer near the Pavillion natural gas field revealed glycols and other synthetic chemicals associated with hydraulic fracturing. [Red emphasis added.]

Daniel Yergin: The real stimulus: Low-cost natural gas — The Wall Street Journal [Paid subscription]

An unconventional oil and gas revolution is under way in the United States, but its full ramifications are only beginning to be understood. The basic facts are clear enough. Half a decade ago, it was assumed that the U.S. would become a large importer of liquefied natural gas; now the domestic natural gas market is oversupplied, thanks to the ability to produce shale gas through hydraulic fracturing and horizontal drilling technologies. [Red & bold emphasis added.]

Webmaster's comment: The basic facts are not clear enough for Downeast LNG's Dean Girdis, who is standing on his head to make an upside-down LNG market look right-side-up. Even standing on one's head, there is no future in yet another idle LNG import terminal.

The big new push to export America’s gas bounty — The New York Times, New York, NY

[This same article appears under the Gulf of Mexico heading, above.]

The Houston energy company [Excelerate Energy] plans to build a multibillion-dollar offshore export terminal halfway between Corpus Christi and Galveston to ship natural gas around the world.

“Asian companies are out in front in signing natural gas contracts,” said Teri Viswanath, a commodity strategist at the French bank BNP Paribas in New York. “For countries like China, the tremendous domestic demand ensures it will always be an importer.”

Webmaster's comment: Teri Viswanath's opinion that Chila will always be a natural gas importer may or may not be true. China is a vast country with its own vast shale gas assets that it has not yet developed.

Mexico

Sempra to construct gas pipeline in Mexico — LNG World News

After a competitive and transparent international public bidding process, Sempra Mexico’s offers were selected to develop the new pipeline network. The network will be comprised of two segments that will interconnect to the U.S. interstate pipeline system in Arizona and will provide natural gas to new and existing CFE power plants that currently use fuel oil. The capacity for each segment is fully contracted by CFE under two 25-year firm capacity contracts denominated in U.S. dollars.

Webmaster's comment: ...More US natutal gas exports.

2012 October 22 |

New Brunswick

Five groups left eyeing Repsol LNG assets sale (Oct 21) — MarketWatch

[This same article appears under the Caribbean heading, below.]

Five groups out of the initial 15 are still interested in buying the liquefied natural gas assets put up for sale by Spanish oil company Repsol SA, reports Cinco Dias in its Monday Internet edition, citing unidentified sources.

The potential buyers are Russia's Gazprom OAO and Novatek, as well as China Petroleum & Chemical Corp, known as Sinopec, India's Gail and France's Total, the paper adds. [Red & bold emphasis added.]

Webmaster's comment: The assets Repsol has for sale include the majority stake in Canaport LNG in New Brunswick, Canada, and interest in Atlantic LNG at Point Fortin in Trinidad and Tobago, West Indies.

Passamaquoddy Bay

LNG: Downeast LNG persists in its application for a Passamaquoddy Bay Terminal – Time for FERC to reject the last outstanding application. (Oct 20) — The Bay of Fundy Explorer

From tourism to whales to cotton-tail rabbits Downeast LNG doesn’t understand Passamaquoddy Bay. It’s now long past the time for FERC to reject the last outstanding application to place an import LNG terminal in Passamaquoddy Bay, a process that, if it weren’t so serious, would be a comedy about how the dead keep walking. [Red, yellow & bold emphasis added.]

LNG: Cartoon leaves vital questions unanswered about LNG in Passamaquoddy Bay. (Oct 8) — The Bay of Fundy Explorer

“If large Cruise ships can come through Head Harbour Passage, what’s so wrong with LNG tankers?”

The answers are two-fold....

Maine & New England

Fracking for gas to thank for Maine’s growing electricity market (Oct 21) — Bangor Daily News, Bangor, ME

The increased natural gas supply has reduced its price in the United States, and New England, according to Dolan at the New England Power Generators Association.

New England’s gas-fired power plants no longer need to buy natural gas from the Gulf of Mexico or import it from overseas, Dolan says.

“Now it’s just coming from Pennsylvania and Ohio. It’s cheap gas and there’s a huge amount of it,” Dolan says. “Projections say over 100 years worth of new gas supply.” [Red, yellow & bold emphasis added.]

Webmaster's comment: Downeast LNG wants you to believe this isn't so.

Gulf of Mexico

Sabine Pass LNG files Monthly Status Report — LNG Law Blog

Sabine Pass LNG filed a status report on construction of its LNG export terminal in Sabine Pass, La., stating that as of the end of September, engineering is 24.2% complete, procurement is 20.6%, and the overall project completion is 11.8%. Sabine Pass states that the overall project schedule is progressing ahead of the contractual schedule basis, with significant acceleration of the Train 1 and Train 2 substantial completion dates from the contractual basis. Early targets for Train 1 substantial completion and Train 2 substantial completion are 43 and 47 months, respectively, against the contractual basis of 49 and 58 months for Train 1 and Train 2.

No time to waste on LNG (Week of Oct 21) — Petroleum News, Anchorage, AK

While proponents of Canada’s LNG are digging in, determined to negotiate oil-indexed prices, Sabine Pass has already done deals tied to Henry Hub gas prices for the Sabine operation.

Shigeru Muraki, executive vice president of Tokyo Gas, told a gas conference in London earlier in October that the U.S. shale gas boom could supply LNG to Japan at sustainable prices up to 40 percent lower than current oil-indexed capital prices.

“U.S. domestic gas prices cannot be the ultimate determinant of gas price in other global markets,” [United Kingdom’s BG Group chief executive officer Frank Chapman] argued. “But we do not expect this to drive a convergence of Henry Hub prices and Asian term prices. We expect gas prices to remain highly regional for the foreseeable future.”

DOE grants applications to export LNG to FTA Nations — LNG Law Blog

The U.S. Department of Energy (DOE) recently granted authority to Cheniere Marketing, LLC (Cheniere Marketing) and Gulf Coast LNG Export, LLC (Gulf Coast) to export domestically produced LNG to nations with a Free Trade Agreement with the United States. Cheniere Marketing proposes to export LNG from its Corpus Christi LNG terminal and Gulf Coast LNG would export LNG from its proposed Brownsville, Texas terminal. [Red emphasis added.]

DOE delays decision on Cheniere Energy facility (Oct 19) — American Press, Lake Charles, LA

The Sierra Club is fighting regulators over all applications from companies interested in exporting LNG. Complaints have also been filed against Sempra Energy’s Cameron LNG facility, which plans to develop a $6 billion LNG export terminal in Hackberry.

Corpus Christi Liquefaction bids for 100% of feeder pipeline capacity (Oct 19) — LNG Law Blog

In an open season held earlier this month, Corpus Christi Liquefaction, LLC bid for 100% of the capacity of Corpus Christi Pipeline for a twenty-year term. The pipeline is proposed to interconnect with Corpus Christi Liquefaction’s LNG terminal. No other bids were received.

Editorial: Cheniere's LNG terminal merits OK by feds (Oct 19) — Beaumont Enterprise, Beaumont, TX

If the U.S. Department of Energy needs to take longer to approve plans by Cheniere Energy Inc. to build an export terminal for liquefied natural gas in southwest Louisiana, that's OK. A major facility like this should be thoroughly vetted.

Caribbean

Paulwell has no fear (Oct 21) — Go-Jamaica, Kingston, Jamaica, West Indies

Energy Minister Phillip Paulwell says he is not worried about a possible probe by the Office of the Contractor General (OCG) of his role in the controversial Liquified Natural Gas (LNG) project.

'We had no choice' - Paulwell defends Government's decision to turn over LNG project to JPS (Oct 21) — The Gleaner, Kingston, Jamaica, West Indies

Since last week, reports have surfaced that at least two major players involved in the Government's initial plan to introduce LNG have urged the Office of the Contractor General (OCG) to probe the decision to turn over the project to the JPS.

Sources in the energy sector have reported that the OCG has been asked to see if Paulwell breached the rules and short-circuited the process by approaching the JPS in March, even while the LNG Steering Committee was still trying to pull together the project.

JPS committed to LNG, says Tomblin (Oct 21) — The Gleaner, Kingston, Jamaica, West Indies

President and Chief Executive Officer of the Jamaica Public Service Company (JPS) Kelly Tomblin has expressed cautious optimism that a successful liquefied natural gas (LNG) arrangement will be eked out in talks between the Government and her company, although the attempt to ink a deal remains on slippery slope.

Last month, the Government scrapped the LNG project as it was being designed and passed it over to the JPS.

Five groups left eyeing Repsol LNG assets sale (Oct 21) — MarketWatch

[This same article appears under the New Brunswick heading, above.]

Five groups out of the initial 15 are still interested in buying the liquefied natural gas assets put up for sale by Spanish oil company Repsol SA, reports Cinco Dias in its Monday Internet edition, citing unidentified sources.

The potential buyers are Russia's Gazprom OAO and Novatek, as well as China Petroleum & Chemical Corp, known as Sinopec, India's Gail and France's Total, the paper adds. [Red & bold emphasis added.]

Webmaster's comment: The assets Repsol has for sale include the majority stake in Canaport LNG in New Brunswick, Canada, and interest in Atlantic LNG at Point Fortin in Trinidad and Tobago, West Indies.

Alaska

Export permission: Where do Lower 48 LNG terminals stand? — Alaska Dispatch, Anchorage, AK

Indeed, that shale gas glut is currently driving a mini-boom of LNG export projects across the Lower 48, driving companies to seek better prices for their product and to draw down bloated storage capacity. As of mid-October, 19 terminal projects in the Lower 48 have applied for permission to export domestically produced LNG.

Just as it used to be difficult to follow all of the different proposed Alaska gas pipelines, it gets hard to follow so many different Lower 48 export projects. According to trade magazine LNG Global's handy chart of domestic LNG project export applications, most of the terminals have obtained federal permission to export LNG to countries the U.S. has a free-trade agreement with. [Red, yellow & bold emphasis added.]

British Columbia

Prince Rupert LNG project in jeopardy after feds reject Petronas takeover — The Northern View, Prince Rupert, BC

Petronas Carigali Canada — a division of the Malaysian oil and gas giant — has actively been pursuing a liquid natural gas export site on Lelu Island. However, the decision to reject the deal — announced by Industry Minister Christian Paradis late Friday night — casts doubts on the project but not a death blow.

In a statement issued early Monday, Petronas said, they along with Progress Energy Resources Corp. officials, will meet with Industry Canada to question the decision. The company has 30 days to appeal the decision.

B.C. LNG plans at crossroads after Petronas-Progress deal blocked (Oct 21) — The Globe and Mail, Toronto, ON

The government’s decision to block the foreign takeover of a mid-sized Canadian natural gas company adds another note of uncertainty to ambitious plans for natural gas exports to Asia that in recent weeks have been thrown into doubt.

Failure of the Petronas terminal could have broader ramifications, since the Malaysian company is expected to share the cost of a $6-billion to $8-billion pipeline to the coast with BG; Spectra Energy Corp. has agreed to build that line.

Troubles with Canadian LNG projects have already started to surface: Japanese research suggests far more gas exports are being proposed than the world will need. Kitimat LNG, meanwhile, acknowledged earlier this month it is having difficulty securing oil-indexed sales contracts, which would provide better pricing and stability than contracts indexed to feeble North American gas prices. Those troubles generated recent Internet rumours that Kitimat LNG has been postponed. In a statement, spokesman Paul Wyke said those rumours are false: the project has completed final engineering, and continues to prepare for construction, he said. [Red & bold emphasis added.]

Energy Biz Wrap: Apache postpones Kitimat, Canada looks at Petronas bid [Opinion] (Oct 21) — Wall St. Cheat Sheet, Asheville, NC

Apache Corporation has postponed its proposed $3 billion Kitimat project, while competitors have undercut its ability to win customers to long-term supply contracts, leaving Kitimat without sufficient clients to start construction. Observers say that Cheniere Energy offers liquefied natural gas at prices that are based on the less expensive Henry Hub benchmark, driving potential Apache buyers to drive a harder bargain. [Red & bold emphasis added.]

Apache LNG Plan in Limbo — The Wall Street Journal

Hopes were high just a couple years ago. The Houston-based energy company in 2010 offered financial backing to the first major effort to ship North American shale gas to Asia, taking a stake in a proposed export terminal in Kitimat, a coastal town in Canada's British Columbia. The nearly $3 billion export project, which involved liquefying natural gas for shipments that were to begin in 2017, gained the Canadian government's approval last year.

But Anglo-Dutch oil company Royal Dutch Shell has since disclosed a bigger project in the same town. Its project is financed in part by big Asian buyers of liquefied natural gas, known as LNG, ensuring it a ready market.

In the U.S., Cheniere Energy Inc., LNG also of Houston, joined the fray, securing contracts for a proposed U.S. Gulf Coast project with Spanish, British and Asian clients by promising prices pegged to the cheap natural gas rates now prevailing in the U.S.

Their plans have undercut Apache's ability to sign customers to long-term supply contracts and left its proposed Kitimat project without enough clients to begin construction. [Red & bold emphasis added.]

Natural gas strategy nothing more than a fairy tale [Opinion column] (Oct 19) — The Vancouver Sun, Vancouver, BC

Alas, this story is too good to be true. Many are questioning whether these ventures work at all from a corporate profitability perspective, given interest by other countries in LNG exports. But it is also the case that economic benefits for ordinary British Columbians, in terms of jobs and government revenues, will be minuscule, and environmental costs high.

B.C.’s plans for expanding the natural gas industry would be like adding 24 million cars to the roads of the world. And emissions from extraction and production would mean B.C. breaking with 2007’s Greenhouse Gas Reduction Targets Act, and its 2020 target of a 33 per cent reduction in GHG emissions.

The government’s assertion that B.C.’s natural gas is good for the climate because it will displace coal use in China is wishful thinking. Natural gas will only pile on to China’s growing demand for energy. Meanwhile, Japan wants LNG to displace its nuclear capacity, which will mean a major increase in their emissions.

BC missing natural gas boat to China [Opinion] (Oct 19) — EcoLog, Toronto, ON

British Columbia (B.C.) is missing lucrative trade opportunities because of overlapping and outdated legislation affecting the export of liquefied natural gas (LNG) to Asia, a new study from the Fraser Institute concludes.

Oregon

Groups file suit over LNG tanker safety — The Daily Astorian, Astoria, OR

WARRENTON — Citizen groups have filed a lawsuit in the Ninth Circuit Court of Appeals to challenge the safety of proposed Liquefied Natural Gas (LNG) tankers on the Columbia River.

Columbia Riverkeeper, Columbia-Pacific Commonsense and Wahkiakum Friends of the River are asking the U.S. Coast Guard to take a hard look at threats to communities, such as explosions and “cascading failures” of LNG, and impacts to the environment. [Red & bold emphasis added.]

Editorial: We are pawns in the LNG game — The Daily Astorian, Astoria, OR

The Port executive director and commission in 2004 should not have committed a prime public asset for any such use without seeking meaningful participation from neighbors and local voters. This violation of a basic democratic principle of including residents in important decisions poisoned the reception for any resulting LNG proposal.

Many of the same objections that applied to siting a large LNG importation plant on the Skipanon waterfront also apply to an export facility. These include concerns about river traffic safety, placing a large quantity of explosive material in a place subject to massive subduction-zone earthquakes, conflicts with existing river uses, and worries about LNG pipeline safety and expansion.

The flaw in the federal LNG terminal siting process is that it contains no strategy. The federal process only rewards the company that gets to the Federal Energy Regulatory Commission first.

It is dangerous to build a regional economic future on energy schemes. That was the fundamental flaw in the Port of Astoria’s lurch in this direction.

Hawaii

Groups oppose plan to ship LNG to Hawaii (Oct 19) — Star Advertiser, Honolulu, HI

Among the concerns expressed by the two groups in documents filed today with the Federal Energy Regulatory Commission is that bringing in LNG runs contrary to the state’s push to reduce its dependence on fossil fuel.

Environmental groups file protests on Hawaiian LNG import proposal — LNG Law Blog

Sierra Club filed a protest on The Gas Company's FERC application to import into Hawaii LNG produced in the continental United States. Sierra Club opposes Gas Company's request that FERC review only the first phase of the project and requests that FERC prepare an environmental impact statement on all phases of the proposal. Sierra Club's protest also raises other environmental issues related to alleged increases in natural gas production that would be induced by the project.

Blue Planet Foundation also filed a protest arguing that the application does not provide enough details on the comprehensive LNG import plan and that the proposal will continue Hawaii's dependence on imported fossil fuels. [Red emphasis added.]

Canada

Nexen-CNOOC deal in trouble after Canada blocks Petronas bid — iStockAnalyst

Canadian industry minister Christian Paradis stated that the Government "was not satisfied that the proposed investment is likely to be of net benefit to Canada"....

...Canadian Security Intelligence Service (CSIS) had warned that foreign investment in the country could be a security issue. While the vast majority of foreign investment in Canada is carried out in an open and transparent manner, certain state-owned enterprises (SOEs) and private firms with close ties to their home governments have pursued opaque agendas or received clandestine intelligence support for their pursuits here.

Cash-Rich Asian companies face North American snub — Wall Street Journal Live

Cash-Rich Asian companies face North American snub — Wall Street Journal Live

VIDEO: Opposition in Canada to a bid by Malaysia's Petronas for one of its gas companies could signal tough times for Asian companies seeking acquisitions in North America. The WSJ's Simon Hall tells us why the Petronas deal could set a bad precedent.

Canada well-positioned to fulfill rapidly increasing need in Asia-Pacific [Policy briefing] — The Hill Times, Ottawa, ON

We have the third largest proven oil reserves, and are the third largest producer of natural gas and the second largest producer of uranium. However, over 99 per cent of our oil and 100 per cent of our gas exports go to the United States. Canada and the United States have the largest bilateral trade relationship in the world—and that will continue. However, the U.S. has discovered huge oil and gas reserves of its own. Furthermore, our oil is selling at a significant discount to international prices, which is costing the Canadian economy billions of dollars of lost revenue. Therefore we must diversify our markets to the fastest growing economies, in particular the Asia-Pacific region.

[F]ive Liquefied Natural Gas projects ... are being developed on our Pacific Coast, including three at Kitimat, B.C., which plan to be in service between 2014 and 2019. Additional LNG export terminals and related pipeline infrastructure are also being proposed for Prince Rupert. Based on these projects, Canada could export the equivalent of nine billion cubic feet per day of natural gas as LNG, or 66 million tons a year, worth tens of billions of dollars to our GDP. [Red & bold emphasis added.]

Natural gas industry ‘still hurting’ despite price bounce (Oct 18) — Financial Post, Don Mills, ON

A crucial factor is the gas glut in the United States, which remains elevated despite massive mothballing of gas wells.

“We anticipate U.S. oil development should contribute 2.1 billion cubic feet per day of incremental gas supply in 2012 and 1.7 bcf per day of additional gas output in 2013, thus dampening the effect of a lower gas rig count,” says Jason Gerdes, an analyst at Canaccord Genuity. Still, he remains bullish enough to predict natural gas prices in the U.S. to hit “at least” US$4 this winter and US$5 long term.

In short, the U.S. gas glut and market dynamics remain a drag on Canadian natural gas production. While Canadian gas exports to the U.S. hit a 14-year low in 2011, U.S. natural gas exports to Canada hit a record high last year, highlighting the structural changes to the Canada-U.S. energy equation. [Red & bold emphasis added.]

United States

US policy uncertainty delays LNG supply growth: BG Group — The Economic Times, India

A shale gas boom in the United States has sparked plans for a large liquefied natural gas (LNG) export industry, but fears that exports could feed energy prices have spurred a strong lobby to limit gas exports.

Study casts fresh doubt on prospects for US LNG export plans — Lloyd's List Australia [Paid subscription]

US exporters of liquefied natural gas face an uphill struggle, according to a new study, because the longer that projects take to be approved, the more serious the consequences for the fleet that will carry the cargoes from the projects.

Analysts say that approval delays could throw the LNG carrier fleet into disarray because so many owners, anticipating a boom in US exports within a few years, ordered new vessels with that supply in mind.

New lobbying effort to promote LNG exports exposes oil and gas industry’s hypocrisy — NorthCentralPA.com, PA

Washington, D.C.—“Today, the oil and gas industry announced the Center for Liquefied Natural Gas, its latest effort to promote fracking for fracking’s sake. The Center will lobby for federal approval of facilities to export liquefied natural gas. Such approval would allow the industry to maximize its profits by selling fracked gas overseas to India, China and other nations.

“But what about the industry’s rhetoric regarding U.S. energy security? The industry’s claims of energy security through fracking are a ruse, and industry’s push to export fracked gas proves it. The industry wants unrestricted drilling and fracking to increase its bottom line.

“The truth is that fracking is a dangerously false solution to America’s energy challenges.”

Webmaster's comment: "Energy security" means having adequate energy availability. Shipping energy overseas reduces US energy security.

RPT-Exclusive-U.S. LNG group to launch campaign for natural gas exports (Oct 21) — Reuters

Backers of liquefied natural gas will launch the first major campaign on [October 22] to press lawmakers to allow the sale of more U.S. gas abroad, as the industry push for exports intensifies.

The effort by the Centre for Liquefied Natural Gas will include a new web site and outreach aimed at policymakers and the public, making the case that selling the nation's surplus natural gas to foreign countries will yield significant economic benefits and not drastically raise prices.

Webmaster's comment: The Center for LNG will promote anything that returns a profit to their membership, regardless of the economic impact on the US economy or the public.

Campaign launched to push LNG exports — PennEnergy, Houston, TX

Thus far many legislators have avoided confronting the possibility of LNG exports because many manufacturers and refineries are opposed to the higher prices that would result. Natural gas exploration, however, could be limited without exports and The New York Times notes that many energy companies have seen net losses to this point.

Natural gas group launches campaign to promote LNG exports – *Update — FuelFix, Houston, TX

CLNG [Center for LNG] President Bill Cooper tells me that he supports the official federal review process for LNG export permits. But he’s concerned about the “ de facto moratorium” on permit approvals.

“A revolution in American energy has unlocked a vast supply of natural gas, more than enough to meet the needs of our country for generations to come,” said CLNG President Bill Cooper in a written statement. “We can continue to harness this important resource for our domestic needs while also selling some to our trading partners. This will grow our economy, revitalize our manufacturing sector, and create tens of thousands of American jobs.” [Red & bold emphasis added.]

Group enters natural gas export debate to nudge administration — The Hill, Washington, DC

"Prior to approving a proposal to export natural gas, the Natural Gas Act requires the Energy Department to determine that the proposed export is consistent with the public interest. That public interest determination includes, among other factors, both economic and environmental considerations," the DOE official said.

Waller LNG Services applies to export LNG, USA (Oct 19) — LNG World News

Waller Point LNG is seeking authorization to export domestically produced LNG from its proposed liquefaction facilities and terminal, Waller Point LNG Terminal, presently under development by Waller Marine for intended construction, ownership and operation at its approximate 180 acre site which it has secured at the entrance point of the Calcasieu Ship Channel in Cameron Parish in Southwest Louisiana, to any nation that currently has or develops the capacity to import LNG and with which the United States currently has, or in the future enters into, a Free Trade Agreement (FTA) requiring the national treatment for trade in natural gas and LNG.

Webmaster's comment: Waller Point LNG is the proposed terminal name that is yet to be permitted by FERC.

Applications received by the DOE to export domestically produced LNG as of October 12th, 2012 (Oct 16) — LNG Global, El Segundo, CA

Webmaster's comment: The entire article consists of a table and footnotes. Here is a list of the applicants:

- Sabine Pass Liquefaction

- Freeport LNG Expansion and FLNG Liquefaction [This is a separate docket than #8, below.]

- Lake Charles Exports

- Carib Energy (USA)

- Dominion Cove Point LNG

- Jordan Cove Energy Project

- Cameron LNG

- Freeport LNG Expansion and FLNG Liquefaction [This is a separate docket than #2, above.]

- Gulf Coast LNG Export

- Gulf LNG Liquefaction Company

- LNG Development Company (d/b/a Oregon LNG)

- SB Power Solutions

- Southern LNG Company

- Excelerate Liquefaction Solutions I

- Golden Pass Products

- Cheniere Marketing

- Main Pass Energy Hub

- CE FLNG

- Waller LNG Services

Total FTA export volume for all 19 applicants would be 27.58 Bcf/d (billion cubic feet per day).

Total non-FTA export volume for the above would be 21.06 Bcf/d.

A typical existing US LNG import terminal capacity is around 1.2 Bcf/d.

Mexico

Peru LNG ships cargo to Mexico (Oct 19) — LNG World News

The cargo is being hauled by the 173,400 cubic-meter Barcelona Knutsen, and it is sailing to Mexico’s Manzanillo terminal.

Asia

Asia needs to develop gas trading hubs for pricing on regional fundamentals: IEA chief — Platts

"Despite the volume of its gas consumption and trade, one fundamental thing is missing in this region: trading hubs, where natural gas would be priced not in relation to oil but depending on regional supply and demand fundamentals," she said, in an address at the opening of the Singapore International Energy Week.

She pointed to the wide variations of LNG prices as symptomatic of the problem, with LNG going into Japan this past summer at $18/MMBtu, compared with gas prices in the US at $3/MMBtu and in Europe of $10-$12/MMBtu.

2012 October 18 |

British Columbia

Bluff and bluster rings hollow [Letter to the editor] — Burnaby NewsLeader, Burnaby, BC

Just when you think things are bad, they get worse. Almost simultaneous with Clark’s “chump change” remark was the breaking news that a U.S.-based natural gas company concluded an agreement to deliver LNG to China at a deeply discounted price, but a price nevertheless based on current market realities. Energy Minister Rich Coleman tried to dismiss the deal as having no significant impact on the development of LNG exportation in B.C., but his not-to-worry message rang hollow.

Bluff and bluster doesn’t change the fact that the LNG train seems to have left the station without B.C. aboard. [Red & bold emphasis added.]

Canada

Ewart: Global giants snap up Canada assets — Edmonton Journal, Edmonton, AB