US

Canada

Passamaquoddy

|

Loading

|

"For much of the state of Maine, the environment is the economy" |

|

News Articles

about

Passamaquoddy Bay & LNG

2012 July

| 2016 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2015 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2014 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2013 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2012 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2011 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2010 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2009 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2008 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2007 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2006 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2005 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2003 – 2004 | |

2012 July 31 |

Gulf of Mexico

Freeport signs LNG-export agreement with Osaka Gas, Chubu — Bloomberg Businessweek

The deal with Freeport is designed to reduce LNG prices in Japan, which are generally linked to the cost of oil, Kei Takeuchi, associate director for LNG trading at Osaka Gas, said at the press conference. [Red & bold emphasis added.]

Webmaster's comment: Selling LNG cheaply via this agreement means the US trade deficit will benefit less. Meanwhile, it may result in more expensive natural gas prices in the US.

Osaka Gas, Chubu Electric eye Henry Hub pricing for Freeport LNG — Platts

"We are hoping to add a new page in our history of procurements with the introduction of the Henry Hub gas price linkage," Hiroki Sato, Chubu Electric's general manager of fuels department and head of LNG business, told a press briefing in Tokyo. [Red & bold emphasis added.]

Webmaster's comment: Basing LNG-to-Japan prices on the US Henry Hub has the potential to de-link the current LNG pricing based on oil-equivalency.

Freeport LNG project secures Japanese contracts — Houston Business Journal, Houston, TX

Freeport LNG inks liquefaction tolling deals with Osaka Gas and Chubu (USA) — LNG World News

Cheniere Partners signs off on Sabine Pass investment — Reuters

USA: Cheniere makes FID for two liquefaction trains — LNG World News

Caribbean

Editorial - Mair Getting It Right On Energy — The Gleaner, Kingston, Jamaica, West Indies

Alaska

BP in talks on potential US gas exports — (Dow Jones Newswire) Capital.gr, Hellenic Republic (Greece)

Webmaster's comment: This same article is posted under United States, below.

TransCanada tries again to attract gas line interest (Jul 30) — Anchorage Daily News, Anchorage, AK

TransCanada tries again to find customers for Alaska gas pipeline (Jul 30) — Alaska Dispatch, Anchorage, AK

United States

BP in talks on potential US gas exports — (Dow Jones Newswire) Capital.gr, Hellenic Republic (Greece)

Webmaster's comment: This same article is posted under Alaska, above.

2012 July 30 |

New Brunswick

Repsol courts suitors for LNG asset sale (Jul 27) — ICIS Heren, London, England, UK

A less attractive asset in the current market, but one that could have potential export value in the future is the Spanish company's 75% stake in the 1 billion cubic feet (bcf)/day capacity Canaport terminal on Canada's east coast. [Red, yellow & bold emphasis added.]

Webmaster's comment: This same story appears under the Caribbean heading, below.

Gulf of Mexico

Cheniere Partners signs off on Sabine Pass investment — Reuters

Caribbean

Repsol courts suitors for LNG asset sale (Jul 27) — ICIS Heren, London, England, UK

A less attractive asset in the current market, but one that could have potential export value in the future is the Spanish company's 75% stake in the 1 billion cubic feet (bcf)/day capacity Canaport terminal on Canada's east coast. [Red, yellow & bold emphasis added.]

Webmaster's comment: This same story appears under the New Brunswick heading, above.

Alaska

TransCanada, Exxon study interest in new Alaska pipeline — The Globe and Mail, Toronto, ON

TransCanada to gauge interest in Alaska LNG project — Reuters

British Columbia

LNG Canada files for export licence — LNG World News

Oregon

Expansion of natural gas pipeline through Washington would feed LNG terminal in Oregon (Jul 28) — The Republic, Columbus, IN

Canada

Petronas sweetens bid for Calgary-based Progress Energy by $500 million (Jul 28) — The Vancouver Sun, Vancouver, BC

“Canada is going from their No. 1 customer being the U.S. and now their No. 1 competitor being the U.S. with the increased gas production in the U.S. When you have a customer that’s a competitor with no other market, LNG is, in my mind, almost a must.” [Red & bold emphasis added.]

United States

US should ease rules for LNG exports, says GAIL — Business Standard, New Delhi, India

Webmaster's comment: Sabine Pass LNG is selling LNG at fire-sale prices, as compared with the world price tied to oil.

New frontiers: a debate over the prospect of US energy independence — The Barrel

Would US energy self reliance insulate the US from foreign entanglements?

2012 July 27 |

Caribbean

Samsung selected through transparent bidding - Paulwell — Jamaica Gleaner, Kingston, Jamaica, West Indies

Opposition seriously concerned about LNG — Go-Jamaica, Kingston, Jamaica, West Indies

Samsung snags LNG project (Jul 25) — The Gleaner, Kingston, Jamaica, West Indies

British Columbia

Shell Canada and partners file LNG export license application with Canada's National Energy Board — LNG Law Blog

Natural gas now officially clean energy for LNG (Jul 25) — EnergyCity.ca, Fort St. John, BC

Webmaster's comment: The new "British Columbia Law of Chemistry": Burning natural gas is polluting, but we can "think" that pollution away.

United States

US shale gas glut cuts BG Group profits (Jul 26) — Financial Times, London, England, UK

2012 July 24 |

Atlantic Canada

India mulls natural gas imports via Atlantic Canada (Jul 18) — Embassy, Ottawa, ON

That system has been used as a method of unloading liquefied natural gas from foreign sources for use in East Coast, central Canadian, and US markets, but is now being seen by several overseas markets as a potential conduit in reverse. [Red & bold emphasis added.]

Webmaster's comment: You may be thinking Downeast LNG will switch to LNG exporting if it can get FERC permits. Keep this in mind: LNG liquefaction terminals require around 490' x 900' of space for just one liquefaction train. Downeast LNG already has too little space for an import terminal; it has no room for liquefaction and export.

New Brunswick

Environmentalist questions Canaport LNG's future — CBC News

John Herron, president of the Atlantica Centre for Energy, says he shares that concern.

Gas Natural CEO says approached by Repsol regarding LNG asset sales — Platts

The company holds stakes in three regasification plants, at Reganosa and Saggas in Spain and one in Puerto Rico. It also has stakes in liquefaction plants at Damietta, Egypt and Oman and is working on two new reception terminals at Trieste and Taranto, both in Italy. [Red, yellow & bold emphasis added.]

Webmaster's comment: This same article appears under the Gulf of Mexico and Caribbean headings, below.

Repsol may sell Canaport LNG, report says (Jul 20) — CBC News

Northeast

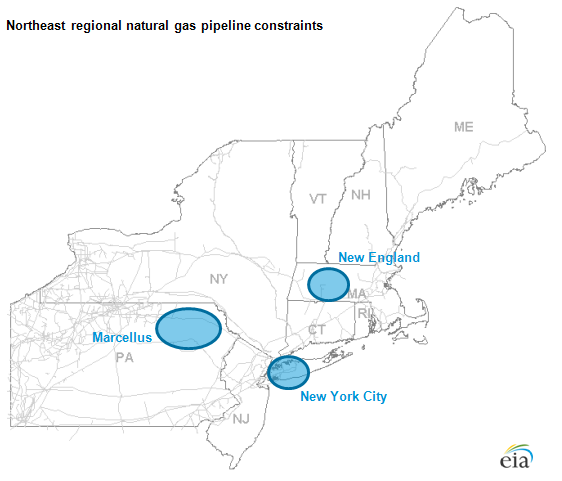

EIA: Spot gas prices at Marcellus trading point reflect pipeline constraints (USA) — LNG World News

Further, Bentek Energy estimates that there are over 1,000 natural gas wells that have been drilled in northern Pennsylvania but which are not yet producing natural gas because there is not enough interstate and gathering pipeline infrastructure to accommodate the new production. [Red, yellow & bold emphasis added.]

Webmaster's comment: Downeast LNG president Dean Girdis' disingenuous take on this plentiful domestic gas and pipeline expansion news: No! That's not happening! LNG imports are the only answer.

Gulf of Mexico

Gas Natural CEO says approached by Repsol regarding LNG asset sales — Platts

Webmaster's comment: This same article appears under the New Brunswick heading, above, and the Caribbean heading, below.

Caribbean

CH-IV provides Owner Engineering services to EcoElectrica for LNG terminal expansion, Puerto Rico (Jul 19) — LNG World News

Gas Natural CEO says approached by Repsol regarding LNG asset sales — Platts

The company holds stakes in three regasification plants, at Reganosa and Saggas in Spain and one in Puerto Rico. It also has stakes in liquefaction plants at Damietta, Egypt and Oman and is working on two new reception terminals at Trieste and Taranto, both in Italy. [Red, yellow & bold emphasis added.]

Webmaster's comment: This same article appears under the New Brunswick and Gulf of Mexico headings, above.

Alaska

AGPA files with DOE to export LNG from Valdez, Alaska (Jul 17) — LNG World News

British Columbia

B.C. Hydro outlines plans for P.G. region (Jul 20) — Opinion 250, Prince George, BC

Fill ‘er up [Editorial] (Jul 18) — Terrace Standard, Terrace, BC

'Burning a little gas' to fire up the natural gas industry in B.C. (Jul 18) — Rabble.ca, Toronto, ON

LNG projects make no sense [Opinion column] (Jul 17) — The Vancouver Sun, Vancouver, BC

Aside from adding to B.C.'s CO2 emissions, the plants may not be built before the market is flooded

Canada

Canada impacted by falling US natural gas prices (Jul 17) — Platts

United States

Big shift in energy is underway (Jul 20) — Forexpros, Nicosia, Cyprus

The belief that the U.S. must import LNG to make up for the decline in conventional natural gas production has been turned completely on its head by growth in unconventional shale gas. [Red & bold emphasis added.]

LNG: US weighs the cost of gas exports to economy (Jul 17) — Financial Times, London, England, UK

Rebutting the IECA attack on my natural gas exports study [Opinion blog] (Jul 20) — Council on Foreign Relations

North America

North America and East Africa: The rising stars in liquefied natural gas production (Jul 23) — Sierra Express Media, Freetown, Sierra Leone

2012 July 23 |

New Brunswick

Canaport LNG could be on auction block — The Chronicle Herald, Halifax, NS

Irving Oil did not respond to repeated calls and emails for comment on Monday.

Spain's Repsol looks to sell LNG assets: sources (Jul 20) — Reuters

Repsol owns a 75 percent stake in the Canaport import terminal in eastern Canada, which began operations in June 2009. It holds a 20 percent stake in the Peru LNG export plant, which started in June 2010, and also has exclusive export rights from that project. It has been shipping LNG from Trinidad and Tobago since 1999. [Red, yellow & bold emphasis added.]

Repsol studying possible sale of LNG assets amid wider asset sales (Jul 20) — Platts

Maine

Three towns develop plan to bring in natural gas (Jul 17) — The Portland Press Herald, Portland, ME

Webmaster's comment: There is no shortage of natural gas in Maine, or even Boston — but Downeast LNG does not want the public to think otherwise.

Northeast

New pipeline project could lower natural gas transportation costs to New York City (Jul 3) — U.S. Energy Information Administration (EIA)

Webmaster's comment: Seasonal pipeline constraints exist in delivering natural gas to New York City, the Marcellus region of Pennsylvania, and western Massachusetts (not Boston). Those constraints are being addressed with new pipelines and pipeline expansions — but Downeast LNG pretends those projects do not exist. The Energy Information Administration indicates Downeast LNG has its head in the sand.

Gulf of Mexico

FERC issues Supplemental Notice regarding Freeport LNG environmental review (Jul 20) — LNG Law Blog

Corpus Christi responds to comments on scope of environmental review (Jul 17) — LNG Law Blog

Caribbean

Editorial - Caution, Mr Hylton — The Gleaner, Kingston, Jamaica, West Indies

T&T mulls buying Repsol’s LNG stake (Jul 21) — The Trinidad Guardian Newspaper, Port-of-Spain, Trinindad, West Indies

Jamaica, Trinidad LNG talks continue (Jul 20) — Go-Jamaica, Kingston, Jamaica, West Indies

Oregon

Jordan Cove Energy files Draft Resource Reports at FERC — LNG Law Blog

Oregon LNG files at DOE to export LNG to non-FTA nations (Jul 19) — LNG Law Blog

Feds to conduct joint review of Oregon LNG terminal and Washington pipeline expansion (Jul 17) — The Oregonian, Portland, OR

FERC approves pre-filing environmental review process for Oregon LNG export terminal (Jul 17) — LNG Law Blog

Canada

Senators see urgent need for national energy policy (Jul 19) — CBC News

The effort was spearheaded by Tides Canada, an environmental charity.

2012 July 16 |

Northeast

Fitch Ratings: Marcellus Shale presents opportunities and challenges to U.S. (Jul 13) — LNG World News

Webmaster's comment: But, Downeast LNG says new pipelines to supply the Northeast and New England can't be happening!

Gulf of Mexico

Cheniere Energy's LNG export facility will look to have a positive impact on natural gas prices — MarketWatch

Low natural gas prices may draw industries to Louisiana (Jul 15) — NOLA.com

Export terminals on the rise

Caribbean

Golding's US expert out of LNG project; new bids expected by Tuesday (Jul 15) — The Gleaner, Kingston, Jamaica, West Indies

Op-ed: Jamaica, Trinidad and CARICOM — Caribbean Journal, Miami, FL

Alaska

Alaska Gasline Port Authority files at DOE for LNG export authority from proposed Valdez terminal — LNG Law Blog

Canada

Gujarat offers to invest in LNG export terminal in Canada (Jul 14) — The Economic Times

NEB streamlines its gas export license review process — LNG Law Blog

Webmaster's comment: This is utter insanity.

United States

Law of the Sea Treaty [UNCLOS] all but dead with 34 GOP Senators opposing measure — The Huffington Post

[Ultra-conservative members of the US Senate drive another nail into Downeast LNG's coffin — SPB webmaster]

Webmaster's comment: The US failure to ratify joining the UN Convention on the Law of the Sea (UNCLOS; but that opponents like to call "LOST") is yet another blow to Downeast LNG.

Downeast LNG president Dean Girdis deludes himself into believing that LNG ships would be able to transit through Canada's Head Harbour Passage under UNCLOS-defined innocent passage — defying Canada's resolute and repeated prohibition against such transits. But, since the US is not a member of the treaty (and apparently is not about to become a member), the US has no rights under UNCLOS — as is clearly spelled out in the treaty; only treaty member states (member nations) have rights under the treaty.

Without membership in UNCLOS, the US cannot claim UNCLOS-defined innocent passage, and the US has no legal recourse under international law, as even the US Coast Guard Office of Maritime & International Law admits. It appears that the US will not be joining UNCLOS in the near future, driving another nail into Downeast LNG's coffin.

See our page on UNCLOS for more specific details.

Japanese demand may fuel American natural gas prices, an Industrial Info News Alert — MarketWatch

Can tech-driven U.S. energy boom survive challenges? (Jul 12) — Investor's Business Daily

Some 7.609 trillion cubic feet of shale gas will be produced in the U.S. this year, up 11.6% from last year. In 2004, before the industry embraced fracking and HDT, the U.S. produced just 0.604 TCF of shale gas. [Red & bold emphasis added.]

Natural gas glut a dilemma for Obama — Fuel Fix

2012 July 12 |

Gulf of Mexico

FERC Chairman responds to Louisiana officials regarding Sabine Pass LNG export project — LNG Law Blog

Cheniere Partners says gets $3.4 bln in finance commitments — Reuters

Cheniere Partners receives $3.4B firm lender commitments for Sabine Pass Liquefaction Project [Press release] — MarketWatch

FERC approves Cameron LNG boil-off gas re-liquefaction facilities — LNG Law Blog

United States

Points of light (Jul 14 print edition) — The Economist

Gas works (Jul 14 print edition) — The Economist

A liquid market (Jul 14 print edition) — The Economist

Oil-linked LNG 'not reasonable' (Jun 11) — Petroleum Economist [Paid subscription]

Webmaster's comment: The US goldrush to build LNG liquefaction and export facilities may fall just as flat on its face as did the LNG import goldrush.

US LNG set to change price framework (Jun 25) — Petroleum Economist [Paid subscription]

2012 July 11 |

Northeast

FERC vacates authorization for Broadwater Energy’s LNG import terminal (Jul 9) — LNG Law Blog

Webmaster's comment: Downeast LNG does not want the public to believe that the 100-years-plus domestic natural gas supply moots additional LNG import infrastructure, as has happened with Broadwater Energy's LNG project.

Cove Point LNG rate case settlement approved (Jul 9) — LNG Law Blog

Gulf of Mexico

FERC vacates authorization for Cameron LNG's fourth LNG storage tank (Jul 9) — LNG Law Blog

Webmaster's comment: Prolific US domestic natural gas supplies mooted Cameron LNG's fourth storage tank — just as they have mooted Downeast LNG.

Caribbean

Caricom - accentuate the positive [Opinion column] — Jamaica Observer, Kingston, Jamaica, West Indies

British Columbia

Palmer: Uncertainties make it hard to predict when first LNG terminal will be built (Jul 9) — The Vancouver Sun, Vancouver, BC

USA: Apache finds huge shale gas reserves in Liard Basin — LNG World News

Oregon

FERC requests agency participation for environmental review of Jordan Cove LNG export project (Jul 9) — LNG Law Blog

LNG opponents regroup to battle export idea — The Daily Astorian, Astoria, OR [Paid subscription]

CH-IV International prepares FEED for U.S. bi-directional LNG facility on behalf of LNG Development Company LLC (dba Oregon LNG) [Press release] (Jul 7) — redOrbit

United States

Romney campaign hits Obama admin's delay of LNG exports — Reuters

KNOC seeking to invest in US shale gas — Rigzone

2012 July 5 |

Gulf of Mexico

Sierra Club calls for full environmental review of Corpus Christi export terminal proposal — LNG Law Blog

British Columbia

Redefining dirty as clean is no way to cut emissions (Jul 3) — The Vancouver Sun, Vancouver, BC

Gas-fired power plant could boost city fortunes [Opinion] (Jul 4) — Terrace Standard, Terrace, BC

Environment Minister Terry Lake presses for increased coast guard along B.C. shores (Jul 3) — The Vancouver Sun, Vancouver, BC

LNG: Progressive chance or regressive act? (Jul 4) — The Vancouver Sun, Vancouver, BC

...With the North American marketplace awash in natural gas resulting from new shale gas supply options, and B.C. with over 100 years of supply, there is urgency required to ensure the multibillion-dollar LNG export investments occur soon. [Red & bold emphasis added.]

Progress Energy takeover: Only the beginning? — Resource Investing News, Vancouver, BC

The race for energy resources (Jul 4) — Credit Writedowns

Oregon

Oregon LNG seeks to start environmental review for export project — Platts

Oregon LNG seeks pipeline routes through Columbia, Cowlitz counties — (AP) The Daily News, Longview, WA

Oregon LNG reveals changes to its plans (Jul 4) — The Daily Astorian, Astoria, OR

The liquefied natural gas company Oregon LNG is changing its plans for an import facility in Warrenton. Oregon LNG has sent the Federal Energy Regulatory Commission a preliminary application for an LNG export project. [Red & bold emphasis added.]

Webmaster's comment: This is actually old news. FERC has been aware for months of Oregon LNG's plan to export instead of import.

United States

India turns to US shale gas — LNG World News

Shale gas has turned the US market upside down from shortage into glut. USA now tries to find markets abroad. According to US Energy Information Administration, the US has the world’s second largest shale gas reserve of 862 tef, right after China’s 1,275 tef. [Red & bold emphasis added.]

Webmaster's comment: Downeast LNG wants the public to believe the natural gas glut does not apply to New England and the Northeast, even though new pipelines and pipeline expansions are in progress to deliver domestic-sourced natural gas to Boston and New York

North America

Americas LNG Markets to 2020- Analysis and Forecasts of Terminal wise Capacity and Associated Contracts, LNG Trade movements and Prices — ReportLinker

2012 July 3 |

Northeast

Pre-filing procedures approved for Cove Point’s proposed export terminal facilities (Jul 2) — LNG Law Blog

Webmaster's comment: Cove Point LNG demonstrates that the Northeast does not need LNG imports. Downeast LNG is moot.

Gulf of Mexico

Withdrawal of TORP Terminal LP, Bienville Offshore Energy Terminal liquefied natural gas (LNG) deepwater port application (Jun 26) — Federal Register

Webmaster's comment: MARAD (US Maritime Administration) had approved this project's permit in 2010. Unlike Downeast LNG and its financial backers Kestrel Energy Partners and York Town Energy Partners, TORP's developers recognized reality back in January — there is no need for additional US LNG import infrastructure.

TORP’s Bienville offshore energy terminal application withdrawn (Jul 2) — LNG Law Blog

United States

Lawmakers: Speed up natural gas exports (Jul 2) — Fuel Fix

The push comes amid a surge in domestic natural gas production from shale rock formations that has caused a glut of the fossil fuel and kept domestic prices low. [Red & bold emphasis added.]

Don't let US lose global LNG race, Reps. tell DOE (Jul 2) — Law360 [Paid subscription]

New EIA model needed for LNG exports: Sieminski – Gas Business Briefing — Exporter Magazine, Morris, NY

The Energy Information Administration could provide guidance to policymakers on the impact of liquefied natural gas exports, but the agency lacks a good model for forecasting the likelihood and potential volume of such exports, EIA Administrator Adam ... [Red & bold emphasis added.]