US

Canada

Passamaquoddy

|

Loading

|

"For much of the state of Maine, the environment is the economy" |

|

News Articles

about

Passamaquoddy Bay & LNG

2015 February

| 2016 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2015 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2014 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2013 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2012 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2011 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2010 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2009 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2008 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2007 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2006 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2005 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2003 – 2004 | |

2015 February 26 |

Passamaquoddy Bay, Maine & New England

King expresses support for natural gas pipeline, opposition to LNG exports — The Free Press, Rockland, ME

Last Friday, Senator Angus King made a stop at the Island Institute in Rockland to discuss energy sustainability and economic development. King, who is a member of the Senate Energy and Natural Resources Committee, said his top three priorities are expanding natural gas pipeline into New England, blocking natural gas exports and supporting renewable energy.

In a written statement Congressman Poliquin made a similar argument but in support of the bill, arguing that increasing LNG exports will help America become more energy independent and will "create untold thousands of new American jobs while protecting our natural environment." [Colored & bold emphasis added.]

Webmaster's comment: Finally, a Maine US Senator has taken a stand against LNG! Hats off to Sen. King!

On the other hand, Maine's freshman US Representative Bruce Poliquin supports LNG exports, claiming that selling off America's natural gas supply somehow would make the US energy independent! Rep. Poliquin believes in eating one's cake, and having it, too — a mutually-exclusive condition that even school children know is impossible. More natural gas drilling (and related methane emissions) would also mean more environmental damage — not less. Rep. Poliquin seems severely logic-challenged on this issue.

2015 February 22 |

New Brunswick

UK-bound LNG tanker diverted towards Canadian import terminal (Feb 18) — (Reuters) Yahoo

The British Merchant liquefied natural gas (LNG) tanker has been diverted towards Canada's Canaport import terminal after initially being listed as bound for the UK's Isle of Grain port, shipping data showed.

The 130,000-cubic-metre-capacity tanker loaded cargo at Trinidad and was initially listed as due to arrive at Isle of Grain on Feb. 25, but is now listed as bound for Canaport, ship-tracking software on Reuters Eikon shows.

Irving pipeline gets retroactive approval from EUB (Feb 20) — CBC News

New Brunswick's Energy and Utilities Board has granted an Irving Oil company retroactive permission to build an oil pipeline that the company already built without permission last year.

New Brunswick's Pipeline Act lists no financial or other penalties for breaking its rules and none were imposed.

Irving said because the 900-metre line is entirely on its own property it didn't realize permission was required.

[The pipeline] crosses three properties that are subject to a special tax concession granted to the Canaport LNG facility and the province has been investigating whether that compromises the terms of that deal.

Maine

LePage joins governors’ coalition supporting offshore drilling (Feb 19) — Portland Press Herald, Portland, ME

LePage says he's interested in natural gas exploration, and it's unclear if his membership in the coalition will lead to his advocacy for offshore drilling in the Gulf of Maine.

Adrienne Bennett, LePage’s spokeswoman, said Thursday that the governor “believes we must secure energy independence and he is particularly interested in the exploration of natural gas.”

She added, “We’ve got to move toward a low-carbon energy future. He believes natural gas is a good choice and it can play an important role in lowering Maine energy costs, particularly heating costs for Mainers.”

LePage joins the governors of Alabama, Louisiana, Mississippi, North Carolina, South Carolina and Virginia as members of the coalition.

Webmaster's comment: Earth to Gov. LePage: Natural gas is not low-carbon energy.

Southeast

LNG export prospects dim (Feb 20) — Savannah Morning News, Savannah, GA

[This article also appears under the United States heading, below.]

"This burgeoning industry is running out of customers and investors to fund new multibillion-dollar projects, according to panelists who spoke Tuesday at a New York University symposium on U.S. gas exports. Oil and gas producers are flooding the market, sinking prices and giving pause for what had been one of the most active sectors in finance," the blog begins.

For Savannah, the most interesting prediction is what will happen to the projects that have not yet received full approval from the Department of Energy. The $1 billion plus conversion of Elba Island to an export facility by Southern LNG Company is among those without full approval. [Colored & bold emphasis added.]

British Columbia

After delay in LNG deal, Petronas chiefs to visit B.C. in March — The Globe and Mail, Toronto, ON

On Dec. 3, Petronas and its four Asian partners placed the venture on hold indefinitely due to anticipated high capital costs that make the project uneconomic to build.

Since then, Petronas-led Pacific NorthWest LNG has made progress in extracting cost savings from prospective contractors and suppliers, B.C. Deputy Premier Rich Coleman said. “Evidently, those costs have come down dramatically,” he said in an interview.

The Petronas-led group estimates that $36-billion will need to be spent in order to achieve planned exports to Asia in 2019. The huge budget includes $6.7-billion in two pipeline projects and $11.4-billion for the export plant at Lelu Island, located near Prince Rupert in northwestern British Columbia.

While Pacific NorthWest LNG’s co-owners delayed their final investment decision 11 weeks ago, they still plan to go through a crucial preliminary phase called engineering, procurement and construction (EPC). Whether the project will ultimately be cancelled or revived will hinge largely on the outcome of Pacific NorthWest LNG’s review of three competing EPC bidders.

Ron Loborec, Canadian energy leader at Deloitte & Touche LLP, said declining prices for LNG in Asia and new supplies from Australia and the United States will pose challenges for the nascent B.C. LNG sector. Still, B.C. proponents stand to benefit by hiring from a pool of workers no longer needed in Alberta due to slumping oil prices while the lower loonie makes LNG exports more attractive, he said. [Colored & bold emphasis added.]

Tanker traffic worries area residents (Feb 18) — Coast Reporter, Sechelt, BC

In Squamish 175 people attended an open house Jan. 28 to discover how to submit comments and ask questions about the proposed Woodfibre LNG plant during the Environmental Assessment Office (EAO) public comment period, which runs until March 9.

Another 152 attended the West Vancouver open house held last Thursday, while a smaller crowd of 116 gathered at Bowen Island Friday evening to hear more about the liquefied natural gas facility planned for Howe Sound at Squamish.

“Marine and shipping safety” was one of the main concerns expressed during the open houses, EAO project assessment manager Michael Shepard told The Squamish Chief.

As she perused the displays at the event, Ruth Simons of the Future of Howe Sound Society said she was having trouble getting Woodfibre LNG to answer her questions. She was searching for a specific map but said none of the staff seemed to be able to find it for her among the Woodfibre displays and thick binders about the proposed project. [Colored & bold emphasis added.]

Canada aboriginal group weighing equity stake in LNG project (Feb 20) — Reuters Canada

PORT ALBERNI, British Columbia (Reuters) - A Canadian aboriginal community that has partnered with Steelhead LNG on a proposed major liquefied natural gas export terminal plans to decide within months whether to take an equity stake in the $30 billion project, one of its leaders said.

The Huu-ay-aht are working with the Vancouver-based company on the planning and design of the 24 million tonne per year plant on their land in British Columbia.

While the project benefits from strong aboriginal support, it does face challenges. Located on the remote western side of Vancouver Island, a long and expensive pipeline is needed to ship gas to the proposed site.

Energy projects a pipeline toward trouble (Feb 19) — The Powell River Peak, Powell River, BC

Enbridge Northern Gateway Pipeline project is toxic and politically toxic, according to the member of parliament who represents much of the territory the project will pass through.

In terms of projects that are underway, Cullen said energy corporations are carving up the landscape in his riding, which represents one-third of BC’s landmass and is geographically larger than Poland. He said there are 13 or 14 liquefied natural gas (LNG) pipeline proposals, plus the Northern Gateway bitumen pipeline and others, all following different paths.

“This is not sanity,” Cullen said. “Even if one accepts the presumption of the desperate need to get energy to Asia, this is not the way you go about doing it. The people where I live are overwhelmed. Every week there is another proposal popping up. Every second night there is another open house with another company proposing another idea to move energy a different way.”

Oregon

Wyden talks LNG, port dispute, and life in the Senate minority (Feb 21) — The Daily Astorian, Astoria, OR

U.S. Sen. Ron Wyden, threading the politically sensitive question of building LNG terminals in Oregon, said he wanted to ensure that the developers of the Jordan Cove Energy Project at Coos Bay had the chance to make their case as the West Coast exporter of natural gas.

The Oregon Democrat described Oregon LNG, which wants to build an export terminal on the Skipanon Peninsula in Warrenton, as “behind Jordan Cove in the queue.”

Environmentalists, property owners, fishermen and residents are challenging the Oregon LNG project as a threat to the Columbia River, property values and health and safety.

Webmaster's comment: Sen. Wyden was previously opposed to LNG exporting. Pro-LNG lobbyists have apparently been effective in changing his position — despite both Jordan Cove LNG and Oregon LNG locations violating the LNG industry's own terminal siting best safe practices as per the Society of International Gas Tanker and Terminal Operators (SIGTTO).

Puerto Rico

Final Environmental Impact Statement on Aguirre Offshore GasPort (Feb 20) — FERC

Project (Docket No. CP13-193-000)

The staff of the Federal Energy Regulatory Commission (FERC or Commission) has prepared a final environmental impact statement (EIS) for the Aguirre Offshore GasPort Project (Project), proposed by Aguirre Offshore GasPort, LLC (Aguirre LLC), a wholly owned subsidiary of Excelerate Energy, LP.

The proposed Project facilities include the construction and operation of an offshore marine liquefied natural gas (LNG) receiving facility (Offshore GasPort) located about 3 miles off the southern coast of Puerto Rico, near the towns of Salinas and Guayama, and a 4.0-mile-long subsea pipeline connecting the Offshore GasPort to the Aguirre Power Complex in Salinas. A Floating Storage and Regasification Unit (FSRU) would be moored at the Offshore GasPort on a semi-permanent basis. Ships would dock at the Offshore GasPort and deliver LNG to the FSRU. Both the ships and the FSRU would be under the jurisdiction of the U.S. Coast Guard.

Canada

Canada offers tax breaks for LNG (Feb 20) — UPI

Nation's energy regulator, NEB, says LNG facing economic headwinds.

SURREY, British Columbia, Feb. 20 (UPI) -- The Canadian government is offering tax breaks to encourage the development of an emerging liquefied natural gas industry, the prime minister said.

Capital spending through 2024 may be eligible for a 30 percent tax relief on equipment and a 10 percent break on facilities that would be used in the nation's LNG industry. Canadian Prime Minister Stephen Harper announced the measure was meant to create the right conditions for the nation's LNG sector to be competitive on a global scale.

A report from Canada's National Energy Board said conventional natural gas exports have declined in part in response to the growing production of gas from shale deposits in the United States. NEB said it's received more than 20 LNG export licenses since 2014, though export terminals have yet to break ground.

Ottawa’s tax measure ‘moves the needle’ for B.C.’s LNG, but doubts persist (Feb 20) — Financial Post, Don Mills, ON

TORONTO — The federal government has sweetened the deal for would-be natural gas exporters with new tax measures, but the industry is still fretting about feasibility of West Coast projects amid a deteriorating LNG price environment.

AltaCorp. Capital’s estimates show that $1 billion spent on LNG equipment would translate into $30 million in tax savings.

While welcoming the decision, Michael Culbert, president of Pacific NorthWest LNG project said Friday these are not “tax breaks” and the industry would still be paying the same amount — just over a different time period.

While the industry has successfully secured a range of benefits from the B.C. and federal governments, there is still no certainty whether the West Coast greenfield industry will take off.

“We expect most already-approved LNG projects, including those in Australia and the U.S., will go ahead, but others planned may not materialize,” Dmitry Marinchenko, associate director at Fitch Ratings said in a note. [Colored & bold emphasis added.]

United States

LNG export prospects dim (Feb 20) — Savannah Morning News, Savannah, GA

[This article also appears under the Southeast heading, above.]

"This burgeoning industry is running out of customers and investors to fund new multibillion-dollar projects, according to panelists who spoke Tuesday at a New York University symposium on U.S. gas exports. Oil and gas producers are flooding the market, sinking prices and giving pause for what had been one of the most active sectors in finance," the blog begins.

For Savannah, the most interesting prediction is what will happen to the projects that have not yet received full approval from the Department of Energy. The $1 billion plus conversion of Elba Island to an export facility by Southern LNG Company is among those without full approval. [Colored & bold emphasis added.]

Mexico

Sempra signs MOU to develop Mexican liquefaction facility (Feb 20) — LNG Law Blog

Sempra Energy has announced that its subsidiaries IEnova and Sempra LNG have signed a Memorandum of Understanding with a subsidiary of PEMEX, Mexico’s state-owned petroleum company, for cooperation and coordination in developing a natural gas liquefaction facility at the site of the existing Energía Costa Azul LNG import terminal near Ensenada, Baja California, Mexico.

China

China’s LNG import terminals half-idle in 2014 (Feb 23) — Hellenic Shipping News Worldwide, Hellas (Greece)

China used just over half its LNG regasification capacity in 2014, as tariff hikes and cheaper competing fuels hit gas demand growth, according to an Interfax analysis of customs data.

Although the Shanghai terminal operated at near capacity, gas demand growth in the city collapsed. The Shanghai office of the National Development and Reform Commission said in January that Shanghai Gas, the local distributor, supplied 6.82 billion cubic metres of gas in 2014 – up by just 0.2% year on year. [Colored & bold emphasis added.]

World

LNG shipping rates nosedive — MarineLink.com

With LNG prices down as slowing demand combines with rising output, the cost to ship super-chilled natural gas has also tumbled to the lowest level in more than four years and is forecast to fall further, reports Bloomberg

According to Andrew Buckland, a London-based analyst at Wood Mackenzie Ltd rates to transport liquefied natural gas have declined to about $50,000 per day and will probably go lower before recovering. In 2012 it was more than $140,000 a day.

There has been reports that over a dozen liquefied natural gas (LNG) tankers are parked, many idle, in and around Singapore - one of the world's biggest trading hubs for the fuel - in a sign that the slowdown engulfing world gas markets may be worsening into a crisis.

The crash in demand in Asia is so severe that some analysts say the future of the entire LNG industry may be impacted. "The weakness in energy markets is threatening to derail LNG's emergence as the pre-eminent energy source," ANZ bank said this week in a research note. [Colored & bold emphasis added.]

2015 February 17 |

Maritimes, Maine, New England & Northeast

Saint John LNG files export application (Feb 16) — LNG Industry

Saint John LNG Development Company Ltd has filed an application with Canada’s National Energy Board (NEB) for a licence to export LNG and a licence to import natural gas, each for a period of 25 years.

The licences are for the company’s proposed LNG liquefaction project in Saint John, New Brunswick, Canada. The licences require authorisation for:

- The import of natural gas from the US to Eastern Canada.

- The export of LNG from Eastern Canada to international markets.

The quantity of natural gas that may be imported in any 12-month period will not exceed 7.70 billion m3, or 271.97 billion ft³ (with an annual tolerance of 15%). The point of import of natural gas into Canada will be the point at which the Maritimes & Northeast Pipeline crosses the Canada-US border near St. Stephen, New Brunswick.

The company, which is a subsidiary of Spanish energy giant Repsol, plans to convert the currently under-utilised Canaport import facility in Saint John into an export facility. The LNG regasification facility commenced operations in 2009, and currently operates with a maximum sendout capacity of 1.2 billion ft³ /d.

New assets at the facility will include a barge landing facility; natural gas liquefaction infrastructure; LNG truck loading facilities; and other associated utilities and infrastructure.

Webmaster's comment: Canaport LNG, just 60 miles east of proposed Downeast LNG, already exists as an import terminal, and would be adding liquefaction and export capability. Canaport LNG is currently operating at around 9% of capacity, and is losing its shirt. Downeast LNG wants to lose its shirt, too, by building an entirely new LNG import & export terminal when there clearly is no need to do so.

Feds approve Cape Breton's Bear Head LNG project — The Chronicle Herald, Halifax, NS

According to Liquefied Natural Gas Ltd. of Australia, it has received the necessary Canadian regulatory approvals for its long-awaited LNG terminal at Bear Head, near Point Tupper, Richmond County.

Due to the fact that partial construction of the LNG facility has already taken place, the Canadian Environmental Assessment Agency has told the company that its Environmental Assessment Act does not apply to the LNG component of the project.

The Bear Head LNG project aims to be the first in Canada to export liquid natural gas, with construction expected as early as this year.

Anadarko received approval for Bear Head a decade ago, but the project was later mothballed because no natural gas supplier could be found to import to the terminal.

Bear Head LNG is also waiting for word on an application to the United States Energy Department for a licence to export [from the US], via pipeline, 503 billion standard cubic feet a year to Canada. [Colored & bold emphasis added.]

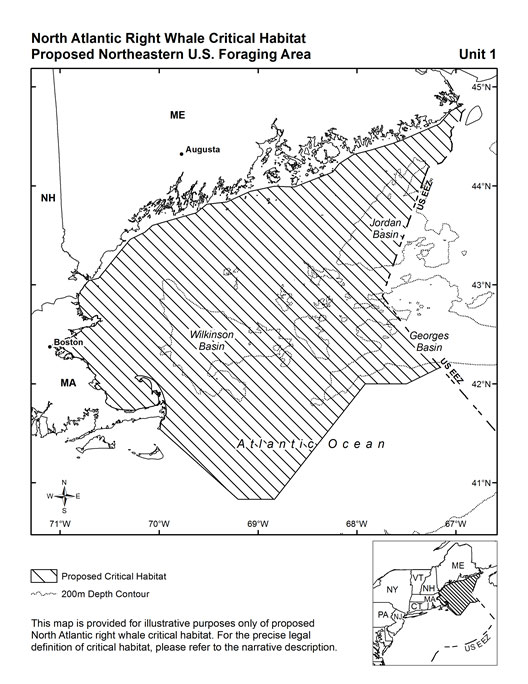

New Critical Habitat proposed for north Atlantic right whales — NOAA Fisheries

Based on a comprehensive right whale status review conducted in 2006, we concluded that genetic data supported three distinct right whale lineages as separate species: North Atlantic right whales, North Pacific right whales, and southern right whales. In 2008, we listed North Atlantic and North Pacific right whales as a separate species under the ESA. In 2009, we were petitioned to revise critical habitat for North Atlantic right whales. Since being petitioned, we revised the existing critical habitat by completing the rulemaking process already underway.

The proposed critical habitat, which you can see in the maps below, greatly expands the previous designation. The key benefit of designating critical habitat is that other Federal agencies are put on notice that they must consult with NOAA Fisheries if they intend to authorize, fund, or carry out an action that may affect right whale critical habitat. This activity does not include any new restrictions for commercial fishing operations or shipping lanes.

Webmaster's comment: Note that Grand Manan Channel — the passage between Grand Manan, NB, and the Maine coastline that is proposed for use by Downeast LNG ships — is included in the Proposed Critical Habitat.

Energy companies keep quiet on this front (Feb 14) — ecoRI News, RI

Pipeline expansion could carry natural gas right out of the region

Left out of the talking points that support expanding pipelines in New England are the efforts by energy companies to deliver that natural gas to Canada for export overseas.

Documents show that developers are already moving forward with this concept. Last October, Pieridae Energy filed a federal application to send domestic natural gas from Massachusetts to Nova Scotia, where it would be converted to liquefied natural gas (LNG) and exported. According to Peiridae, a company in Germany has already agreed to buy the exported LNG.

To get to Nova Scotia, the natural gas would travel through the 889-mile Maritimes & Northeast Pipeline from Dracut, Mass. The pipeline’s owner, Spectra Energy of Houston, has already applied to reverse the direction of the pipeline flow to reach the Maritime Provinces.

The Dracut hub connects to, and is near, several pipelines, including the Algonquin Gas Transmission pipeline, which travels through New York, Connecticut and Rhode Island before it reaches Massachusetts. The Algonquin pipeline is awaiting approval for a major upgrade to expand capacity, as is the Tennessee Gas Pipeline (TGP) that runs to Dracut. The TGP Northeast Energy Expansion project proposes to add 126 miles of transmission line across the upper portion of Massachusetts and southern New Hampshire to connect with Dracut.

“Far from enhancing our energy independence or energy security, this pipeline will accelerate the depletion of our already vastly overrated domestic gas reserves because much of the gas will be destined for export," said Lisa Petrie of the environmental advocacy group Fossil Free Rhode Island. "The only true path to energy security — and, more importantly, climate security — is a rapid transition away from fossil fuels to renewable-energy sources."

The comment period for Pieridae Energy’s application with the Department of Energy closed Feb. 9. Pipeline opponents have started a petition to extend the comment period. They say the pipeline expansions, which include massive upgrades to compressor stations, increases toxic pollution and the likelihood of fires and explosions. The pipelines also add to the problems with hydraulic fracturing, or fracking, which is linked to polluted aquifers, earthquakes, toxic waste and air pollution, and increasing greenhouse-gas emissions from extraction and transporting the gas.

However, 44 cities and towns have passed resolutions against the pipeline or to have a greater say in the project. Opponents object to the pipeline running through dense forests, wetlands and drinking-water supplies. To quell some of the opposition, the Northeast Direct expansion has been presented a plan to detour a portion of the new pipeline through existing power-line rights of way in New Hampshire, bypassing six Massachusetts towns.

Last month, Massachusetts senators Elizabeth Warren and Edward Markey, both Democrats, sent a letter to FERC seeking that the pipeline approval process be more thorough.

Both of those letters came after a Jan. 22 letter from Richard Blumenthal, D-Conn., Susan Collins, R-Maine, Angus King, I-Maine, Christopher Murphy, D-Conn., and Jeanne Shaheen, D-N.H., asked that the approval process for AIM be sped up to help with home-heating demands and energy-infrastructure improvements. [Colored & bold emphasis added.]

British Columbia

B.C. tables balanced budget; LNG boom nowhere to be seen — (The Canadian Press) CTV

VICTORIA -- British Columbia's finance minister tabled a balanced budget Tuesday as he boasted that his province may be the only one in Canada to avoid falling into deficit amid plunging oil prices, but the long-anticipated liquefied natural gas industry has yet to produce one cent.

De Jong toned down his locker-room pep talk when it came to liquefied natural gas. B.C. Premier Christy Clark won re-election in 2013 by promising a multibillion-dollar industry that would create 100,000 jobs and generate enough revenues to wipe out the provincial debt. [Colored & bold emphasis added.]

B.C. adds legislation to regulate LNG development in federal ports — LNG World News

New legislation to regulate the construction, operations and permitting of LNG development on federal port lands was introduced into the B.C. legislature by Deputy Premier and Minister of Natural Gas Development Rich Coleman.

Bill 12, the Federal Port Development Act will extend provincial authority and application of provincial law to LNG-related development on federal port lands, stands in a statement. The bill creates a seamless regulatory environment that complements the 2014 amendments to the Canada Marine Act made by the federal government.

Oregon

Environmental groups voice Jordan Cove LNG opposition to FERC — LNG World News

Western Environmental Law Center and Sierra Club submitted comments to the Federal Energy Regulatory Commission opposing what would become the first gas export terminal on the West Coast.

According to the coalition, the project would have significant environmental impacts. These include logging streamside forests, dumping sediment into waterways that are critical habitat for imperiled salmon, fragmenting important wildlife habitat, and extensive dredging in the Coos Bay estuary. The coalition asserts that FERC’s examination of these impacts is insufficient, and important aspects of the analysis have not yet been made available to the public.

The proposal also creates a wealth of safety concerns, including the possibility of spills and explosions. The export terminal would be built on a sand spit that is vulnerable to earthquakes and tsunamis, while contaminated soil problems were noted by a whistleblower that was contracted by Veresen.

The coalition argues that the project would increase controversial fracking, yet FERC chose not to analyze the impacts of accelerated fracking to feed the export terminal. Once Oregon’s lone coal power plant closes in 2020, the Jordan Cove gas export terminal would be the state’s largest greenhouse gas emitter, but the federal analysis fails to consider the climate impacts of the project. [Colored & bold emphasis added.]

EPA wants assurances natural gas project won't harm Oregon's environment (Feb 13) — KUOW-FM, Seattle, WA

The Environmental Protection Agency has waded into the discussion about the proposed liquefied natural gas export terminal in Coos Bay, Oregon.

The federal agency wants assurances the Jordan Cove terminal and associated pipeline won’t harm streams and wetlands in Southern Oregon.

Canada

Harper government considers new LNG tax breaks in federal budget (Feb 16) — Energy City, Fort St. John, BC

The federal government is considering the idea of providing new tax breaks in the upcoming budget for companies looking to set-up LNG export terminals, according to Reuters.

The purpose of new tax breaks – proposed by the Canadian Association of Petroleum Producers (CAPP) – is to give incentive to companies that have stalled LNG development in the midst of falling oil prices, says Reuters.

If implemented, Reuters says the proposed measure would have the federal government lose “hundreds of millions of dollars” in tax revenue. [Colored & bold emphasis added.]

United States

Funding dries up for new U.S. gas export terminals — The Wall Street Journal

This burgeoning industry is running out of customers and investors to fund new multibillion-dollar projects, according to panelists who spoke Tuesday at a New York University symposium on U.S. gas exports. Oil and gas producers are flooding the market, sinking prices and giving pause for what had been one of the most active sectors in finance.

The U.S. shale-gas boom has pushed producers to look abroad to boost their returns. Prices in overseas markets, especially Asia, have been four times as high as the U.S. benchmark. That convinced producers to seek federal permission to export as much as 35 billion cubic feet a day, half of all U.S. production, according to the Department of Energy.

It has fully approved five projects. Three are under construction with Cheniere Energy Partners LP’s Sabine Pass terminal on pace to send out the first shipments later this year. But 28 others still wait in line, said Robert Fee, a senior advisor and fossil-fuel expert at the department. Their path to construction depends as much on international competition as it does on domestic policy.

Big international buyers don’t feel pressure to sign more long-term contracts. The national utility companies that wanted them have already signed, Mr. Boudrais said. Without more committed buyers, financiers won’t step in. They don’t want to take the risk that prices can rise enough to support a profitable spot market. [Colored & bold emphasis added.]

U.S. 2014 LNG imports nosedive (Feb 16) — LNG World News

LNG imports into the U.S. dropped 39.2 percent in 2014 to 50.1 Bcf, as compared to the year before, according to the U.S. Department of Energy data.

Most of the cargoes were shipped from Trinidad and Tobago, and Yemen. The Everett LNG terminal received the majority of the LNG, followed by the Cove point import terminal.

The country exported five cargoes of the chilled gas from Conoco’s Kenai facility in Alaska. All of them were delivered onboard the Excel LNG tanker to Japan’s Kansai Electric.

One cargo was also re-exported in February last year from the Freeport LNG terminal to Brazil. [Colored & bold emphasis added.]

Webmaster's comment: With apologies to Saturday Night Live's Chevy Chase, re Spain's Generalissimo Francisco Fanco — 'US LNG importing is still dead.' (See: Generalissimo Francisco Franko is still dead, Wikipedia)

United States: DOE Inspector General releases findings on FERCís handling of nonpublic information (Feb 13) — Mondaq

On February 4, 2015, the Department of Energy's ("DOE") Office of the Inspector General released a report on the Federal Energy Regulatory Commission's ("Commission") treatment of nonpublic information within the Commission ("Inspection Report"). The "Inspection Report: Review of Controls for Protecting Nonpublic Information at the Federal Energy Regulatory Commission" concluded that the "Commission's controls, processes and procedures for protecting nonpublic information were severely lacking."

Upon completion of its review, the Inspector General found that Commission staff "did not have or implement effective processes to appropriately handle and share Commission-generated electric grid analysis" that contained nonpublic information. Specifically, the Inspection Report noted that when Commission analyses are created using industry information (as was the case with the March 2013 analysis), the analyses are categorized as critical energy infrastructure information ("CEII") and must be protected under the Commission's CEII Guidelines, i.e., maintained in a locked area when not in use. Despite these guidelines, the Inspection Report found instances where the March 2013 analysis was not maintained in a locked environment when not in use, and was removed from Commission premises without proper authorization. The Inspection Report also found instances where Commission staff failed to follow CEII guidelines by improperly sharing the March 2013 analysis with other agencies and congressional staff without first obtaining a nondisclosure agreement. [Colored & bold emphasis added.]

Webmaster's comment: FERC has been too loosey-goosey with Non-Public information — not going to enough length to protect LNG industry information. On the other hand, the Inspector General has not taken the initiative to examine how FERC abuses the Public Interest.

Natural gas exports: Democrats and the Obama Administration — Republic Report

Republic Report and DeSmogBlog released this report about natural gas lobbying on November 20, 2014. Co-authored by Lee Fang and Steve Horn, the report is the result of ongoing investigations into natural gas industry lobbying for LNG exports.

President Obama came into office pledging to tackle climate change and to “close the revolving door” between lobbyists and government. But as the LNGdebate has unfolded, the administration has broken both promises.

The most telling example is Heather Zichal, former Deputy Assistant to the President for Energy and Climate Change, who announced her intention to leave the White House in October 2013. Within months of her departure from public office, Zichal — a key environmental policy staff member to John Kerry when he served in the U.S. Senate — accepted an invitation to join the board of Cheniere Energy. In April 2012, Cheniere had become the first company to win a permit from the Obama Administration to export LNG, an effort that entailed the aid of numerous lobbyists with career ties to the Department of Energy.

White House meeting logs reveal that Zichal met several times with Cheniere lobbyists and executives while working for the Obama Administration. Now, Zichal earns $180,000 annually from the company, not including stock options.

To understand the tight grip Cheniere has on the Obama White House, though, one has to look beyond lobbyists and the Board of Directors and follow the money trail.

…

The revolving door has moved in both directions. Energy Secretary Moniz, a former consultant to BP, previously led the MIT Energy Initiative, which received over $145 million from the oil and gas industry.

At MIT, Moniz also obtained funds from a nonprofit associated with Chesapeake Energy, a leading fracking firm, to chair a report on the “Future of Natural Gas” during a period of his career that DeSmogBlog and other critics have called “frackademia.” Former CIAdirector and current Cheniere board member John Deutch also served on the study group that prepared that report while a colleague of Moniz’s at MIT, as did Melanie Kenderdine, director of the Office of Energy Policy and Systems Analysis and Energy Counselor to Moniz. Moniz also formerly served on the board of directors of ICF International, a consulting firm that services the oil and gas industry. [Colored & bold emphasis added.]

Webmaster's comment: This report is a long, documented, stinging indictment of the Obama Administration's "blind eye" regarding the revolving door between government and the energy industry.

8 ways Obama sucks on climate — Grist

The new conventional wisdom among the political class is that President Obama is doing everything he can without the cooperation of Congress to fight climate change. His administration set higher fuel-economy standards for cars and trucks. It has proposed the first-ever regulations on carbon emissions from power plants, and on methane leakage from oil and gas wells and pipelines. He got China on board with a plan to limit emissions, potentially paving the way for an international climate agreement later this year in Paris. Obama feeds this perception with his public statements, such as emphasizing the importance of climate change in his State of the Union address and musing to Vox.com about how the media fails to cover climate change with the urgency of other national security threats.

But many of the administration’s moves, including a string of recent actions by federal agencies under Obama’s control, show this conventional wisdom to be false. Here are the president’s top eight climate failings, many of them from just the three months since the midterm elections:

- Opening more federal land and water to offshore oil and gas drilling

- Selling off public coal deposits at a loss

- Promoting fracking

- Allowing more gas and oil exports

- Proposing weak rules on methane leaks

- Regulating coal ash like banana peels

- Going soft on ozone pollution

- Counting chopped-down trees as “clean energy”

[Colored & bold emphasis added.]

Asia

Platts JKM(TM) for March-delivered LNG plunges 61.7% in largest year-over-year drop — Stockhouse

Northeast Asian prices fall 25% from previous month on high inventories

SINGAPORE, Feb. 17, 2015 /PRNewswire/ -- Prices of spot liquefied natural gas (LNG) for March delivery to northeast Asia saw their largest year-over-year drop on record, plunging 61.7% from March 2014 to average $7.436 per million British thermal units (/MMBtu), according to latest Platts Japan/Korea Marker (Platts JKM™) data for month-ahead delivery.

The March 2015 monthly average had also dropped 25% from February, as the market shifted into a backwardated* structure, reflecting the seasonal reduction in demand going into the northern hemisphere spring. This exerted further downward pressure on prices, as buyers were in no rush to procure cargoes.

Asia's LNG demand crashes (Feb 13) — The Maritime Executive

"There are currently 30 to 40 (oil and gas) tankers sitting in Singapore, many without anything to do," said Javier Moret, head of LNG origination at Germany's biggest power producer RWE during a conference in Singapore this week.

Singapore's location between producers in the Middle East, Australia and the Atlantic basin and large consumers in Japan, South Korea and China means that most tankers stop by here to take on fuel or undergo repair and maintenance work.

The crash in demand in Asia is so severe that some analysts say the future of the entire LNG industry may be impacted.

Along with energy prices, tanker rates have also tumbled. British-based shipping services firm Clarkson says daily LNG charter rates have fallen from $90,000 in 2013 to $60,000 currently.

Traders said LNG tankers weren't just being idled around Singapore, but that this was also an issue in the Atlantic basin where Europe's economies struggle to return to growth.

Japan and South Korea, the world's biggest LNG importers, have both reduced imports as their economies stutter.

With China's economy growing at its lowest rate in over 20 years, imports there are also slowing, while at the same time as supplies are rising. [Colored & bold emphasis added.]

2015 February 13 |

Canada, United States & The World

LNG tankers lie unused around Singapore as gas downturn turns to crisis — Reuters

- Combined tanker capacity of at least 2.25 mcm LNG lies unused

- Asian LNG prices down almost two-thirds since 2014

- Gas demand stalls just as new supplies come to market

Over a dozen liquefied natural gas (LNG) tankers are parked, many idle, in and around Singapore - one of the world's biggest trading hubs for the fuel - in a sign that the slowdown engulfing world gas markets may be worsening into a crisis.

Leading ship brokers estimate over one-tenth of the global fleet of 400 LNG tankers is currently unused because of slowing growth in Asia's biggest economies. The impact just in Singapore suggests the problem could be worse.

At least partly triggered by the oil price crash, gas markets have seen an Asian price premium over Europe drop from over $10 per million British thermal units (mmBtu) a year ago to a discount of over $1.50, making it unattractive to ship gas between the two regions and eroding tanker demand.

In Asia, LNG prices have fallen to around $6.90 per mmBtu from over $20/mmBtu a year ago. The benchmark British price, meanwhile, is around $8.50/mmBtu.

"The weakness in energy markets is threatening to derail LNG's emergence as the pre-eminent energy source," ANZ bank said this week in a research note. [Colored & bold emphasis added.]

New Brunswick

Repsol subsidiary files application to import U.S. gas supplies for export as LNG from Canaport terminal — LNG Law Blog

Saint John LNG Development Company Ltd., a wholly-owned subsidiary of Repsol St. John LNG S.L., which is indirectly owned by Repsol, S.A. of Spain, has filed an application with the Canadian National Energy Board for 25-year authorization to import 272 Bcf/year of natural gas from the United States via Maritimes & Northeast Pipeline. Saint John LNG Development also applied for 25-year authorization to export 249 Bcf/year of LNG from a proposed liquefaction facility to be located at the existing Canaport LNG import terminal in [Saint] John, New Brunswick. [Colored & bold emphasis added.]

Webmaster's comment: Canaport LNG's export project is a brownfield project, requiring adding liquefaction capability; storage and regasification capability already exists. On the other hand, Downeast LNG is a greenfield project, requiring liquefaction, storage, and regasification capability. Thus, Downeast LNG would cause greater environmental impact than Canaport LNG; and Canaport LNG construction would have no environmental impact at all in the United States. (Canaport LNG export would, though, cause more climate-changing gas pollution up the supply chain — just as would Downeast LNG.)

Oregon

National coalition plus tens of thousands submit comments opposing West Coast fracked gas export plan [Press release] — eNews Park Forest, Park Forest, IL

Portland, Ore.—(ENEWSPF)—February 13, 2015. On behalf of a diverse national coalition, including conservation, commercial fishing and private property owners, the Western Environmental Law Center (WELC) and Sierra Club submitted comments today to the Federal Energy Regulatory Commission (FERC) opposing what would become the first gas export terminal on the West Coast. In addition, more than 25,000 citizens, including businesses, ranchers, youth, climate activists, property rights advocates, anglers, and a Native American tribe sent comments critical of FERC’s analysis of the project.

The project would have significant environmental impacts. These include logging streamside forests, dumping sediment into waterways that are critical habitat for imperiled salmon, fragmenting important wildlife habitat, and extensive dredging in the Coos Bay estuary. The coalition asserts that FERC’s examination of these impacts is insufficient, and important aspects of the analysis have not yet been made available to the public.

“In the 1970s we were always talking about energy independence. Now we have this gas and they want to export it by stealing my land. It just doesn’t make sense,” said Bill Gow, whose family ranch sits in the proposed path of the pipeline and is threatened by eminent domain. “This is not just a environmental fight being opposed by the left. Opposition to this project is across the spectrum and reaches to the far right.” [Colored & bold emphasis added.]

2015 February 12 |

Maine, New England & Maritimes

Repsol seeks export authorization from NEB — LNG World News

Canadian National Energy Board received an application from Repsol this week seeking authorization to export LNG from its Canaport facility.

According to the filing, Repsol intends to import 271 bcf of gas annually via pipeline from the United States which would then be converted to 5 million metric tons of LNG. [Colored & bold emphasis added.]

East Canada LNG export terminal underway — The Maritime Executive

Spanish energy giant Repsol filed an application this week with Canadian regulators to begin exporting liquefied natural gas from its under-utilized Canaport import facility in Saint John, New Brunswick.

The project is one of four LNG export terminals proposed in eastern Canada, aiming to ship abundant North American natural gas to energy-hungry markets overseas. Many more are being proposed on Canada's west coast.

The existing Canaport marine terminal, jointly owned with Canada's Irving Oil, is well-positioned to meet Europe's demands for cheap and dependable gas in the face of the Ukraine crisis, according to analysts. But it would likely depend on big, and potentially controversial, pipeline investments through New England.

Between 2008 and 2013, natural gas imports from eastern Canada to the northeast United States fell by 82 percent, according to data from the U.S. Energy Information Administration. [Colored & bold emphasis added.]

Repsol applies to export LNG from Canaport — CBC News

The Spanish petroleum company Repsol formally applied this week to the National Energy Board for approval to export liquefied natural gas from its Canaport LNG facility in Saint John.

However, the company says that does not mean a decision has been made to proceed with a multi-billion dollar conversion of the plant.

Canaport LNG was built nearly a decade ago with the purpose of importing LNG, regassifying it and sending it into the United States by pipeline.

But enormous shale gas developments in the U.S. have undercut the need for imports and Repsol has been studying whether to convert Canaport into an export facility instead of one used for import purposes. Published estimates have put the cost of that conversion as high as $4 billion.

"[Canaport LNG] is in a privileged location," said [Repsol spokesman Kristain Rix from Madrid]. "It has the largest storage capacity on the east coast of the whole of North America. It is connected with pipelines. It can berth the largest LNG tankers in the world, so the facilities are great." [Colored & bold emphasis added.]

Webmaster's comment: Once again, Downeast LNG is way outclassed by others in the industry, and by a company that is far better connected and has more resources. Still, Canaport LNG would need to acquire US natural gas to make their project work. Exporting US natural gas would reduce US energy independence while simultaneously contributing to climate change.

Two more projects join Canadian LNG export race — Natural Gas Intelligence [Paid subscription]

[This article also appears under the British Columbia and Canada headings, below.]

Spanish and Chinese sponsors stepped forward Wednesday with two fresh entries into the lineup to export liquefied natural gas (LNG) from Canada, increasing the number of terminal projects on both sides of the country to 25.

On the Atlantic Coast, Repsol SA confirmed intentions to convert its six-year-old, little-used New Brunswick import terminal at Saint John, Canaport LNG, into an export site.

A new subsidiary of the Spanish energy conglomerate, Saint John LNG Development Co., filed an application to the National Energy Board (NEB) for a 25-year license to ship out 6.8 Tcf of gas at a rate of up to 785 MMcf/d.

On the northern Pacific Coast of British Columbia, a private Vancouver arm of New Times Energy, a Hong Kong international gas merchant, filed for a 25-year NEB license to export 14 Tcf in tanker cargoes of up to 1.6 Bcf/d.

Repsol's subsidiary seeks both import and export licenses for a potentially blended flow of gas supplies from the United States as well as Canada.

Production could reach the Saint John site from Alberta, BC, and the Marcellus Shale formation in the U.S. via a variety of interconnected Canadian and U.S. pipeline systems, the NEB filing says.

The new filings acknowledge that the outcome of the race to break into the overseas LNG trade will fall far short of the astronomical total ambitions of the project lineup. [Colored & bold emphasis added.]

Western Mass anti-pipeline group MassPLAN mobilizes against Canadian LNG export facility (Feb 10) — MassLive.com, MA

The Western Massachusetts-based anti-pipeline group MassPLAN petitioned this week to intervene in a U.S. Dept. of Energy proceeding that would authorize the export of liquefied natural gas (LNG) through a planned Canadian shipping port.

An "overall scheme of massive pipeline expansion and export of natural gas" is not in the public interest, said MassPLAN director Katherine Eiseman in a statement. MassPLAN stands for Massachusetts Pipeline Awareness Network.

The application from Pieridae Energy requests 20-year authorization to export up to 800 million cubic feet of domestically-produced natural gas per day through the Goldboro LNG facility, which is currently under development in Nova Scotia.

Pieridae seeks permission from the DOE to liquefy natural gas sourced from the Maritimes & Northeast Pipeline, which runs through Maine, and export it via tanker ship to countries with which the United States does not have a free trade agreement, and with which trade is not otherwise prohibited, according to a Dec. 10 notice in the Federal Register.

The Maritimes & Northeast pipeline, which currently runs north-south from Nova Scotia to a distribution hub in Dracut, Mass., would have to reverse direction in order to deliver natural gas from the Marcellus shale play to the Maritimes.

MassPLAN has been at the forefront of opposition to the planned Kinder Morgan Northeast Energy Direct project, which would traverse three western Massachusetts counties while transporting up to 2.2 billion cubic feet of gas daily from Marcellus wells to markets in the Northeast. [Colored & bold emphasis added.]

Battle brewing over renewable energy & natural gas subsidies (Feb 5) — The Free Press, Rockland, ME

Just three months ago, state energy officials were warning that rising electricity prices would reach a crisis point this winter. With price shocks on the horizon due to higher natural gas usage for heating and electricity this winter, Massachusetts had already locked in a 37-percent increase in wholesale electricity prices. However, Maine fortuitously timed its solicitation for pricing bids just as oil prices began precipitously dropping. Last month, the Maine Office of the Public Advocate announced that standard offer electric bills will drop 13 percent in March. In December, New England's power prices were about half of what they were the year before, according to regional grid operator ISO New England.

Although Maine has the lowest electricity costs in New England, like much of the Northeast, it suffers from higher-than-average energy costs. With no domestic fossil fuel resources - like coal, oil and natural gas - the region relies heavily on imports. Just 15 years ago, only 15 percent of the region's electricity generation relied on natural gas, but we have since transitioned nearly half of our generation to that fuel. And with the retirement of oil, coal and nuclear plants, ISO New England estimates that another 8,300 megawatts of generation capacity will be lost by 2020, which it says would require another 6,300 megawatts of gas-fired capacity to replace them. At the same time, according to Maine Public Utilities Commission (PUC) Chairman Mark Vannoy, new EPA carbon pollution standards will require the region to transition to cleaner power generation.

But while the recent natural gas boom has led to record low prices at the wellhead in the past few years, the LePage administration maintains that New England does not have enough pipeline capacity to take full advantage of the low costs. During peak demand times in the winter, as gas flows into New England for heat and electrical generation, congestion occurs. That allows pipeline owners to charge a premium for pipeline usage, which causes our electricity prices to spike.

Through NESCOE, the six New England governors have outlined two energy objectives: Maine wants natural gas, and Connecticut, Rhode Island and Massachusetts want renewable energy in order to meet strict carbon reduction targets. In addition to subsidizing the proposed natural gas pipeline, a regional multi-state plan would also help finance the transmission of power from local wind projects and large Canadian hydro plants. One proposal, the Maine Green Line, developed by Massachusetts-based Anbaric Transmission and utility giant National Grid, would move up to 2,800 megawatts of power from Maine to Massachusetts through buried land lines and undersea cables.

However, plans for a subsidized pipeline have been widely criticized by environmental groups who argue that Maine should not invest so much of its resources in a volatile commodity that could put ratepayers at risk of much higher costs down the road.

Maine Conservation Law Foundation says that there's no need to build out a massive pipeline infrastructure that will be here for several decades when technical fixes appear to already be solving some of the pipeline problems.

While NESCOE continues energy talks, it's unlikely Maine will go it alone on natural gas pipeline expansion, but the LePage administration and its allies have promised to make energy policy a centerpiece in a series of other initiatives this session. Specifically, the governor will likely back measures sponsored by Senate President Mike Thibodeau (Waldo County) to weaken clean power incentives that are already in place, such as Maine's Renewable Portfolio Standards (RPS). [Colored & bold emphasis added.]

Halted: VT gas pipeline (Feb 10) — Conservation Law Foundation (CLF), Boston, MA

Welcome news from Vermont Gas Systems that it will not proceed with Phase 2 of its expensive and polluting natural gas pipeline.

Over recent months, project costs have skyrocketed and pollution impacts increased. New gas pipelines lock us into continued fossil fuel use for decades into the future are a bad bet for our climate and our pocketbooks.

British Columbia

Ewart: B.C. government at a loss for words over LNG's future — Calgary Herald, Calgary, AB

The looming economic windfall from LNG promised by the B.C. government had long been overstated but the harsh realities of the oil and gas industry have left it at a loss for words.

Or at least it’s more leery of bold predictions.

With LNG prices in the Asian markets that B.C. is targeting linked directly to crude, companies are questioning the economics of the multibillion-dollar greenfield developments.

Development costs, future prices for LNG, challenges to construct energy projects in “green” British Columbia, and competition elsewhere — four U.S. LNG plants are under construction with almost seven billion cubic feet of export capability by the end of 2018 — are considered threats to the fledgling industry.

Two more projects join Canadian LNG export race — Natural Gas Intelligence [Paid subscription]

[This article also appears under the Maine, New England & Maritimes heading above, and Canada heading, below.]

Spanish and Chinese sponsors stepped forward Wednesday with two fresh entries into the lineup to export liquefied natural gas (LNG) from Canada, increasing the number of terminal projects on both sides of the country to 25.

On the Atlantic Coast, Repsol SA confirmed intentions to convert its six-year-old, little-used New Brunswick import terminal at Saint John, Canaport LNG, into an export site.

A new subsidiary of the Spanish energy conglomerate, Saint John LNG Development Co., filed an application to the National Energy Board (NEB) for a 25-year license to ship out 6.8 Tcf of gas at a rate of up to 785 MMcf/d.

On the northern Pacific Coast of British Columbia, a private Vancouver arm of New Times Energy, a Hong Kong international gas merchant, filed for a 25-year NEB license to export 14 Tcf in tanker cargoes of up to 1.6 Bcf/d.

Repsol's subsidiary seeks both import and export licenses for a potentially blended flow of gas supplies from the United States as well as Canada.

Production could reach the Saint John site from Alberta, BC, and the Marcellus Shale formation in the U.S. via a variety of interconnected Canadian and U.S. pipeline systems, the NEB filing says.

The new filings acknowledge that the outcome of the race to break into the overseas LNG trade will fall far short of the astronomical total ambitions of the project lineup. [Colored & bold emphasis added.]

Les Leyne: Who knew LNG dreams would fade? [Opinion column] (Feb 11) — Times Colonist, Victoria, BC

Who could have predicted that the trillion-dollar LNG dream would be more than a little oversold? Who could have predicted that a government would confidently bank on a future of limitless prosperity before the first tanker left port?

First LNG exports from BC likely to be small-scale (Feb 11) — Natural Gas Daily, Interfax Global Energy

Small-scale LNG projects on Canada’s Pacific coast are pressing ahead, while their larger and more capital-intensive rivals struggle with low oil and gas prices, slashed capex budgets and reduced Asian demand.

There are 18 large and small-scale export projects planned in British Columbia (BC), but initial enthusiasm for many of them – stemming from abundant reserves and short transport distances to Asia – has turned to uncertainty.

Lower capital expenditure and shorter construction times associated with small-scale LNG give these projects an advantage. They are also being developed by small independent and specialist LNG companies that are not facing the same huge budget cutbacks as the supermajors (see Chevron focuses on Gorgon and Wheatstone amid cutbacks, 2 February 2015).

However, small-scale LNG projects lack the economies of scale offered by the mega-projects and could lose out when it comes to long-distance deliveries to Asia. "What are sometimes called ‘small scale’ are in reality still projects of significant size, that might find savings in construction of the needed infrastructure or can access a different type of smaller and more flexible ships," Perez said, not writing off the potential of these plants to appeal to Asian buyers.

Vancouver-based NewTimes Energy latest entrant into crowded LNG field (Feb 11) — The Globe and Mail, Toronto, ON

A newly formed B.C. company that wants to export liquefied natural gas from Prince Rupert is the 19th entrant in the crowded field of LNG proposals on Canada’s West Coast.

Vancouver-based NewTimes Energy Ltd. filed an application Wednesday to the National Energy Board, seeking a 25-year licence to export 12 million tonnes of LNG annually.

Industry experts say there is only room for four B.C. LNG projects at most, and the economics of ventures big and small have been hurt by falling prices for LNG in Asia.

NewTimes is registered in Vancouver, but it will be counting on investors in China and the United States to help bring the venture to fruition.

LNG sponsorship a ‘conflict’: watchdog (Feb 10) — Vancouver 24 hrs, Vancouver, BC

The BC Liberal Party is being criticized for having Woodfibre LNG as a co-sponsor of a recent fundraiser for the West Vancouver-Sea-to-Sky MLA because the company has a major LNG facility proposal waiting for government approval.

Dermod Travis, IntegrityBC executive director, said it’s inappropriate for political parties to be sponsored by corporations and unions in general, but the main problem is that Woodfibre LNG has a major proposal in front of the province that’s waiting for necessary approvals.

“It puts them in theoretical conflicts,” he said.

Oregon

State warns that Oregon LNG project could disrupt fishing (Feb 11) — The Daily Astorian, Astoria, OR

WARRENTON — Warning of a potentially substantial disruption, the state Department of Fish and Wildlife has recommended that Oregon LNG perform a thorough analysis of the impact of its proposed terminal on commercial and recreational fishing in the Columbia River.

The department, in comments on the project in January to the U.S. Army Corps of Engineers, found that Oregon LNG has not sufficiently characterized the local importance of fishing and the possible disruption during the construction and operation of a liquefied natural gas export terminal on 96 acres along the Skipanon Peninsula.

The project could interfere with access to the Skipanon Marina, popular recreational chinook and coho salmon fishing at the mouth of the Skipanon River known as Buoy 10 and recreational crabbing in the estuary near the proposed terminal’s berthing dock and outside the mouth of Youngs Bay.

Jordan Cove LNG export project faces FERC delay (Feb 9) — Natural Gas Intelligence [Paid subscription]

The Canadian-based backer of the proposed Jordan Cove liquefied natural gas (LNG) export terminal and Pacific Connector transmission pipeline tying it to the western gas grid said on Friday that FERC has delayed until June the date for completing the project's draft environmental impact statement (DEIS). In an environment of depressed global oil prices the delay may prove to be even more problematic.

A coastal project at Coos Bay along Oregon's south-central coast, the 1.2 Bcf/d Jordan Cove project is slated to be a tolling facility with prices linked to Henry Hub, not global oil. It includes a 1 Bcf/d transmission pipeline, Pacific Connector, as well as an adjacent gas-fired generation plant. Last November, Project Manager Bob Braddock told NGI that he expected FERC's DEIS "within the next few days." That was before Thanksgiving and turned out to be wrong. [Colored & bold emphasis added.]

Fossil-fueled economics: LNG terminal bad for fish, Columbia Riverkeeper says (Feb 10) — Portland Business Journal, Portland, OR

The Columbia Riverkeeper is encouraging the Oregon Department of Environmental Quality to reject a proposed liquefied natural gas terminal on the Columbia River, saying the Warrenton-area project runs counter to ongoing efforts to improve habitat for 13 salmon species.

Guam

GPA board approves plan for new plant by 2020 (Jan 28) — Pacific Daily News, Hagatna, Guam

LNG option on hold

Last year, GPA gave a presentation that included the use of liquefied natural gas as a second fuel source for the proposed power plant in the Harmon cliffline area.

Guam doesn't have the seaport facility to offload and process LNG from ships for use at a power plant.

It would take eight to 12 years to build a plant and related infrastructure for LNG, and the U.S. EPA would never agree to that long of a timeline to come into compliance, Duenas said.

Canada

Two more projects join Canadian LNG export race — Natural Gas Intelligence [Paid subscription]

[This article also appears under the Maine, New England & Maritimes and British Columbia headings, above.]

Spanish and Chinese sponsors stepped forward Wednesday with two fresh entries into the lineup to export liquefied natural gas (LNG) from Canada, increasing the number of terminal projects on both sides of the country to 25.

On the Atlantic Coast, Repsol SA confirmed intentions to convert its six-year-old, little-used New Brunswick import terminal at Saint John, Canaport LNG, into an export site.

A new subsidiary of the Spanish energy conglomerate, Saint John LNG Development Co., filed an application to the National Energy Board (NEB) for a 25-year license to ship out 6.8 Tcf of gas at a rate of up to 785 MMcf/d.

On the northern Pacific Coast of British Columbia, a private Vancouver arm of New Times Energy, a Hong Kong international gas merchant, filed for a 25-year NEB license to export 14 Tcf in tanker cargoes of up to 1.6 Bcf/d.

Repsol's subsidiary seeks both import and export licenses for a potentially blended flow of gas supplies from the United States as well as Canada.

Production could reach the Saint John site from Alberta, BC, and the Marcellus Shale formation in the U.S. via a variety of interconnected Canadian and U.S. pipeline systems, the NEB filing says.

The new filings acknowledge that the outcome of the race to break into the overseas LNG trade will fall far short of the astronomical total ambitions of the project lineup. [Colored & bold emphasis added.]

United States

EIA: Henry Hub January spot price falls below USD 3/MMBtu — LNG World News

The Henry Hub natural gas spot price averaged $2.99/MMBtu in January, a decline of $0.49/MMBtu from December, and the first monthly average price under $3/MMBtu since September 2012.

Natural gas futures contracts for May 2015 delivery, traded during the five-day period ending February 5, averaged $2.71/MMBtu. Current options and futures prices imply that market participants place the lower and upper bounds for the 95% confidence interval for May 2015 contracts at $1.79/MMBtu and $4.11/MMBtu, respectively. [Colored & bold emphasis added.]

2015 February 6 |

Nova Scotia

Nova Scotia LNG project would access Canadian gas via U.S. pipes (Feb 3) — Natural Gas Intelligence [Paid subscription]

Bear Head LNG Corp., which is developing a liquefied natural gas (LNG) export terminal in Nova Scotia, is seeking authorization from the U.S. Department of Energy (DOE) to import and then re-export western Canadian natural gas to supply the terminal.

Gas "...would be imported at the various existing -- or future -- points at the U.S.-Canada border along the Western Canada-Northeast and Western Canada-Midwest pipeline corridors, which traditionally have linked western and central Canadian supply areas to U.S. Northeast and Midwest demand regions," Bear Head told DOE in its recent filing.

Bear Head said there are more than 10 "major" points of entry where WCSB gas could enter the U.S. interstate pipeline system, many of which could carry WCSB gas to the Maritimes & Northeast Pipeline (M&NP), which would deliver gas to the terminal. [Colored & bold emphasis added.]

Webmaster's comment: Bear Head LNG is proposing the ship natural gas back and forth across the US-Canada border multiple times, kind of like Downeast LNG's impossible proposal to send LNG ships back and forth across the US-Canadian border in Passamaquoddy Bay — that Canada prohibits.

Northeast

LNG project opponents given tips for waging legal battle — SoMdNews.com, MD

Two out-of-state lawyers encouraged those living near Dominion Cove Point Wednesday evening to adapt their approach to opposing the controversial expansion of the plant by focusing on the everyday nuisances associated with the project, which is currently under construction.

“The best thing you can hope for is to drag it out until it caves in under its own weight, its own publicity,” Speer said.

Middleton said industry has no right to interfere with the peaceful enjoyment of one’s own property, and Maryland law supports this idea. [Colored & bold emphasis added.]

Only veto can stop LNG — The Wave, Rockaway Beach, NY

Viaggio writes Port Ambrose, currently being proposed by Liberty Natural Gas, would consist of a deepwater LNG port and 22 miles of pipeline, and LNG tanker ships would link up with the platform to import fuel for domestic use. Many of the groups opposed to the project say it is likely that their long-term plan is to convert the port to an export facility, so that domestic supply can be shipped overseas to foreign markets.

This past week, Liberty Natural Gas, announced in a press release that nearly 100 groups – including the Queens Chamber of Commerce — have declared their support for the Port Ambrose project. You can read the full interview I conducted with QCC director Jack Freidman in this edition and draw your own conclusions.

However, if you are against the Port Ambrose project and think Andrew Cuomo is going to veto it – which would kill the deal entirely – you may be kidding yourself.

The only other person who can veto the LNG is New Jersey Governor Chris Christie, who vetoed an earlier version of this project in 2011. He may be running for president, so it’s hard to determine if he’ll oppose the clearly conservative-backed proposal.

Queens pols urge veto on LNG project (Feb 5) — Queens Chronicle, Queens, NY

Some Rockaway representatives are not thrilled about the proposal to build a natural gas pipeline 19 miles off the coast of New York, saying there are safety and environmental concerns involved in the construction of the project.

“A lot of it has to do with our reliance on fossil fuels,” Councilman Donovan Richards (D-Laurelton) said. “We have to do more to move away from fossil fuels.”

Richards was expressing opposition to the proposed Port Ambrose Liquefied Natural Gas terminal, which if approved by the state, would be built in the Atlantic Ocean 19 miles away from Jones Beach and about 20 miles away from the Rockaways.

Methane leaks from gas pipelines far exceed official estimates, Harvard study finds (Jan 28) — InsideClimate News

Boston-area infrastructure loses 2-3 times more gas than state authorities say, adding to evidence of downstream systems' role in greenhouse emissions.

Published in the journal Proceedings of the National Academy of Sciences last week, the researchers' paper is the first peer-reviewed study that quantifies emissions of methane, a powerful greenhouse gas, from natural gas installations in urban areas—including pipelines, storage terminals and power plants. The amount of methane lost over a year in the study area is worth $90 million, the authors wrote.

The Boston study found an overall leak rate of 2.1 percent to 3.3 percent in the region, compared with the 1.1 percent estimated by Massachusetts' official state greenhouse gas inventory.

For years, studies focused on methane leaks from the drilling and fracking of natural gas wells. Less attention was given to downstream sources such as the pipelines that deliver gas to residential homes. But a growing body of research indicates they could be important culprits.

Power plants sometimes vent methane into the atmosphere during routine operations. Storage facilities can also leak gas. Contributions could also come from sources in private homes, such as leaky stoves or inefficient furnaces, Jackson said.

Gulf of Mexico

A new Louisiana LNG project is announced as another is delayed (Feb 3) — Natural Gas Intelligence [Paid subscription]

A former executive of BG Group plc on Tuesday said his recently formed company will pursue a liquefied natural gas (LNG) export project in Louisiana, one day after UK-based BG Group said it was delaying a decision on the Louisiana LNG project it is pursuing with Energy Transfer Partners LP.

Environmental groups appeal FERC’s Freeport LNG orders — LNG World News

Sierra Club and Galveston Baykeeper filed a petition with the U.S. Court of Appeals for the D.C. Circuit raising questions about FERC’s orders authorizing construction of Freeport LNG export terminal.

Petitioners question whether FERC made errors in concluding that the effects of the Freeport LNG project on induced gas production were outside the scope of the National Environmental Policy Act indirect and cumulative effects analyses.

Filing further reveals that, among other issues, the petitioners allege that FERC erred in refusing to consider the effects of the project on domestic electric sector air emissions, and that FERC violated NEPA by failing to take a hard look at the project’s air pollution impacts. [Colored & bold emphasis added.]

Webmaster's comment: FERC has exhibited contempt for NEPA in the Downeast LNG proceedings as well.

British Columbia

Chevron pumps the brakes on Kitimat LNG — Alaska Highway News, Fort St. John, BC

Chevron announced last week that they would be decreasing their spending this year on Kitimat LNG, a proposed LNG export facility at Bish Cove, near Kitimat.

As to whether or not the cooling oil market is liquidating B.C.’s LNG prospects, Merlata said it was difficult to tell.

Oregon

Oil prices raise questions about Coos Bay LNG plant (Feb 3) — Houston Chronicle, Houston, TX [Paid subscription]

COOS BAY, Ore. (AP) — The collapse of crude oil prices and its ripple effect on natural gas exploration and production from North American shale deposits raise questions about the prospects for a liquefied natural gas export terminal at Coos Bay, but the Canadian company that proposes it says the long-term investment remains sound.

Canada

NTSB: Systemic flaws in safety oversight of gas pipelines (Jan 28) — InsideClimate News

Three powerful accidents in recent years highlight weaknesses in the oversight of how natural gas providers maintain the largest pipelines in their networks, accident investigators said Tuesday as they issued more than two dozen safety recommendations.

A major effort a decade ago by the federal government to check a rise in violent pipeline failures in "high-consequence" areas where people are more likely to be hurt or buildings destroyed has resulted in a slight leveling off of such incidents, but no decline, the National Transportation Safety Board said.

United States

Renewables beat natural gas, provide half of new US generating capacity in 2014 (Feb 4) — Renewable Energy World

WASHINGTON, D.C. -- Ending a year-long race that had been nip-and tuck every month, renewable energy sources cumulatively provided more new electric generating capacity in 2014 than did natural gas.

According to the latest "Energy Infrastructure Update" report from the Federal Energy Regulatory Commission's (FERC) Office of Energy Projects, renewable energy sources (i.e., biomass, geothermal, hydroelectric, solar, wind) provided nearly half (49.81 percent - 7,663 MW) of new electrical generation brought into service during 2014 while natural gas accounted for 48.65 percent (7,485 MW).

[N]ew capacity from renewable energy sources in 2014 is 34 times that from coal, nuclear and oil combined — or 72 times that from coal, 108 times that from nuclear, and 163 times that from oil.

Can there any longer be doubt about the emerging trends in new U.S. electrical capacity? Coal, oil, and nuclear have become historical relics and it is now a race between renewable sources and natural gas with renewables taking the lead. [Colored & bold emphasis added.]

Carpe diem: Low oil and gas prices could be a clean-energy opportunity (Feb 5) — Renewable Energy World

[C]ould it be that the current environment — with gasoline at less than $2 a gallon in much of the United States — is actually a good time to double down on policies to move away from fossil fuels to more renewables and efficiency?

That’s the conclusion of a special report on energy in the January 17 issue of The Economist headlined “Seize the Day.” “The fall in the price of oil and gas,” writes the venerable magazine that dates back to 1843, “provides a once-in-a-generation opportunity to fix bad energy policies.” Chief among these policies are fossil fuel subsidies, at least some of which were born out of decades-old governmental fear of oil scarcity and soaring prices (I’ll let others debate how many came from mere lobbying power). The Economist calls fossil fuel subsidies a “rathole” which swallowed an estimated $550 billion from governments across the globe last year. “Falling prices provide an opportunity to rethink this nonsense,” the magazine continues. “Why should American taxpayers pay for Exxon to find hydrocarbons?” [Colored & bold emphasis added.]

Europe & Asia

Update: Hammerfest LNG production restart unknown (Jan 28) — LNG World News

Statoil, the operator of the Hammerfest LNG facility, is still unable to estimate the date when production will resume at its facility on Melkøya Island off northern Norway.

The company stopped operations at the liquefaction facility on Tuesday after a gas leak.

The workers at the plant have been evacuated after the gas alarm was triggered. [Colored & bold emphasis added.]

ICIS: Asian spot LNG price falls below UK’s — LNG World News

Spot gas prices in key East Asian markets have fallen below British wholesale levels for the first time since May 2010 amid a global oversupply.

The ICIS East Asia Index (EAX) for March 2015 settled at $6.85/million British thermal units on Wednesday, below the British March 2015 hub price of $6.92/MMBtu.

On the same date last year, the EAX March 2015 price stood at $19.84/MMBtu with the British equivalent contract at $9.90/MMBtu. [Colored & bold emphasis added.]

Webmaster's comment: This puts a huge fly in the ointment for US and Canadian LNG export plans.

2015 February 5 |

Passamaquoddy Bay

Sen. Ron Wyden tasks FERC & PHMSA re permitting standards (Jan 30) — FERC

Sen. Ron Wyden tasks FERC & PHMSA re permitting standards (Jan 30) — FERC

[This same FERC filing appears under the Oregon and the United States headings, below.]

Within the public comments for the Jordan Cove Export Terminal Project (see FERC Docket No. CP I 3-483), serious concerns are raised regarding the adequacy of the hazard modeling used to measure vapor cloud dispersion.