US

Canada

Passamaquoddy

|

Loading

|

"For much of the state of Maine, the environment is the economy" |

|

News Articles

about

Passamaquoddy Bay & LNG

2013 November

| 2016 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2015 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2014 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2013 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2012 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2011 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2010 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2009 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2008 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2007 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2006 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2005 | | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2003 – 2004 | |

2013 November 30 |

New Brunswick & Nova Scotia

Canada's Canaport LNG import terminal keeps re-export option open (Nov 29) — Platts

The company has already received regulatory approval from the province's Department of Environment to load carriers with LNG stored in its tanks. It also has approval from federal regulator National Energy Board, which granted a short-term order to majority stakeholder Repsol to export LNG from the facility, Shannon said. [Red, yellow & bold emphasis added.]

Canaport permit no worry for N.S., developers say (Nov 27) — The Chronicle Herald, Halifax, NS

With a permit in place to reload that natural gas and send it on tankers to more lucrative markets, Canaport could compete with the two export terminals planned for Guysborough County.

But Andrew Parsons, business development adviser for H-Energy, said there is enough natural gas demand for multiple export terminals to set up in Atlantic Canada.

Mark Brown, director of [Pieridae Energy Canada Ltd.] project development for the Calgary company, said Canaport’s approval to export LNG doesn’t change the business case.

Brown said the fact that two companies are interested in the Guysborough area to set up an LNG terminal validates that it is a goodplace to build a facility.

Webmaster's comment: Two companies interested in exporting from the same area "validates" only that they both want to do it; nothing more. We've seen this all before, with three inappropriately-sited LNG import projects in the same area. Put up a project-killing roadblock, and that's "good news," according to the developers. Even after their project is killed dead they continue to claim it's a wonderful idea, and they'll come back.

Canada: LNG re-exports approved for Canaport terminal (Nov 27) — LNG World News

Repsol’s Canaport LNG terminal in Canada has received an approval from the provincial Department of Environment to export previously imported LNG to global markets with better selling prices.

Northeast

Cove Point LNG export: A vision for our energy future? (Nov 27) — Energy Trends Insider

…In ‘04 and ’05, Cove Point hosted almost 80 ships per year bringing in LNG from producers around the world. At that time, U.S. demand looked set to grow inexorably, with domestic supplies unable to meet demand. So, in 2004, Dominion embarked on a large expansion of Cove Point’s capacity, more than doubling its storage capacity. Once completed in 2009, markets had again turned against LNG imports, as the shale revolution pushed down prices and pushed up production. 2011 was the last commercial import of LNG; now two or three ships per year service the facility in order to keep their lights on and fulfil their secondary mission of providing a peak demand service (providing gas to markets in times of high demand). [Red, yellow & bold emphasis added.]

United States

Could the latest LNG approval be the death knell for pending exports? [Blog] (Nov 29) — The Barrel, Platts

The Department of Energy’s decision this month to give conditional approval to a Houston-based company to ship even more liquefied natural gas from its planned export facility appeared to be exactly what many in the industry had been clamoring for.

But after a close-reading of the DOE’s order and discussions with sources familiar with the issue, the recent approval seems to be far less of a victory for the pro-export crowd. In fact, the approval could be interpreted as an ominous decision from an agency wary of sending US gas into the global market and might signal a DOE decision to severely curtail future export authorizations, at least from the US Gulf Coast.

While Freeport received approval to ship 400,000 Mcf/d to non-FTA countries, the approval was 1 Bcf/d less than the approval Freeport was seeking.

[D]id DOE cut the export request by 1 Bcf/d because it believed exports at that level would not be in the public interest? In other words: was the Freeport request reduced by 1 Bcf/d because DOE believes that an additional 1 Bcf/d would not be in the public interest? [Red & bold emphasis added.]

2013 November 27 |

New Brunswick

Canaport LNG given permission to export via tankers (Nov 26) — CBC News

Saint John's Canaport liquefied natural gas terminal has been given permission by the provincial Department of Environment to export natural gas using tankers.

"It's basically there as an option, just in case," she said. "We may start it this winter, or it may not happen at all."

Canaport, which opened in 2009, currently imports liquefied natural gas from locations such as Qatar and Trinidad by tankers, restores it to its original gaseous form through a process called regasification, and moves it by pipeline to American and Canadian markets.

"To be able to receive fairly reasonable priced gas from a place like Trinidad and export it to the far East may be reasonably profitable," [said Marco Navarro-Genie, president of the Atlantic Institute for Market Studies in Halifax]. [Red, yellow & bold emphasis added.]

Webmaster's comment: Downeast LNG wants the world to believe it needs to import. There could be no greater evidence to the contrary.

2013 November 25 |

Maine

Maine wind, Canadian hydro, natural gas: Are the stars aligning for a bright energy future in New England? (Nov 23) — Bangor Daily News, Bangor, ME

LePage is keenly interested in developing additional natural gas pipeline that can bring more of the cheap gas into the region and drive down energy prices that are some of the highest in the nation. While natural gas prices are low, New England has paid the highest daily natural gas prices in the country for much of the past year because of limited pipeline infrastructure flowing into the region.

The Legislature in June passed an energy bill that could lead to Maine ratepayers partially financing a [natural gas] pipeline buildout in southern New England, where the gas could enter New England’s electric grid. It’s that law that has sparked many of the regional energy conversations, Woodcock said.

New England

Office of Energy Projects Energy Infrastructure Update (Oct) — FERC, Washington, DC

[This article also appears under the Northeast heading, below.]

- …

- Tennessee placed into service its Northeast Upgrade Project which will provide increased transportation capacity for two shippers on Tennessee’s existing 300 Line System by 636 MMcf/d in PA and NJ.

- Millennium received authorization to construct and operate its Hancock Compressor Project in Delaware County, NY. This project will provide 222.5 MMcf/d of firm transportation capacity on the Millennium system.

- Algonquin commenced the Commission’s pre-filing process to construct and operate the Salem Lateral Project. This project will provide 115 MMcf/d of firm capacity to Footprint Power’s Salem Harbor Station facility in Salem, MA.

- … [Red & bold emphasis added.]

Webmaster's comment: More pipeline and compressor capacity has been added in the Northeast and New England — something that Downeast LNG's Dean Girdis claims is neigh impossible.

Northeast

Natural gas production in Northeast reduces need from other regions (Nov 24) — Penn State Extension, PA

Compared to 2008 natural gas records, production in the northeast has increased almost 6-fold to 12.3 billion cubic feet (Bcf) per day in 2013. This upward trend has been reflected in lower prices and an increased natural gas supply. Natural gas use in power generation continues to increase, and the inflow of natural gas from other regions, such as the southwest, eastern Canada and from the Midcontinent region, has been declining. [Red, yellow & bold emphasis added.]

EIA: Increased Northeast gas production reduces net inflow of supply from other areas (Nov 19) — LNG World News

Natural gas production in the northeastern United States rose from 2.1 billion cubic feet per day (Bcf/d) in 2008 to 12.3 Bcf/d in 2013. This trend has reduced the cost and increased the supply of natural gas in the Northeast. This additional supply has encouraged greater use of natural gas in the Northeast, especially for power generation, and has … reduced net inflows of natural gas into the region from other regions such as the Gulf of Mexico, the Midwest, and eastern Canada.

During the first nine months of 2013, net inflows of natural gas to the Northeast from all outside sources decreased by 50% from the comparable 2008 period. … Flows on … pipelines from the Southeast into the Northeast have been displaced in part by natural gas produced in the Appalachian Basin’s Marcellus Shale play, where increased production has occurred alongside expansions in capacity to move gas to northeastern consumers….

Between 2008 and 2013, natural gas net inflow from eastern Canada to the Northeast fell by 82%. … The United States also began exporting compressed natural gas (CNG) to Canada this year by truck from Calais, Maine. Beginning in April 2013, there have been days when the Northeast was a net exporter of natural gas to eastern Canada. [Red, yellow & bold emphasis added.]

Webmaster's comment: Maine is exporting natural gas via Calais to Canada! The Northeast is becoming a net exporter to eastern Canada!

Office of Energy Projects Energy Infrastructure Update (Oct) — FERC, Washington, DC

[This article also appears under the New England heading, above.]

- …

- Tennessee placed into service its Northeast Upgrade Project which will provide increased transportation capacity for two shippers on Tennessee’s existing 300 Line System by 636 MMcf/d in PA and NJ.

- Millennium received authorization to construct and operate its Hancock Compressor Project in Delaware County, NY. This project will provide 222.5 MMcf/d of firm transportation capacity on the Millennium system.

- Algonquin commenced the Commission’s pre-filing process to construct and operate the Salem Lateral Project. This project will provide 115 MMcf/d of firm capacity to Footprint Power’s Salem Harbor Station facility in Salem, MA.

- … [Red & bold emphasis added.]

Webmaster's comment: More pipeline and compressor capacity has been added in the Northeast and New England — something that Downeast LNG's Dean Girdis claims is neigh impossible.

British Columbia

Canada: Report highlights air quality challenge of LNG export terminals (Nov 22) — LNG World News

As proposed, three LNG plants planned for Kitimat, B.C. will together burn a quantity of natural gas equivalent to two-and-a-half times combusted annually by the 2.4 million residents of Metro Vancouver – sharply escalating air pollution in the northern city, according to a new report.

LNG in a Nutshell (Nov 20) — The Common Sense Canadian, Vancouver, BC

Damien Gillis stitches together the big picture of the impacts of liquefied natural gas (LNG) and the fracking from which it would derive if the BC Liberal Government’s vision to build five plants on BC’s coast goes forward.

Middle East

Yemen: Navy destroys boat approaching Balhaf LNG port (Nov 22) — LNG World News

A booby-trapped boat approached from international waters, and passed security lines into Yemeni territorial waters in the area surrounding the LNG port. Yemen’s navy moved immediately towards the boat and opened fire, causing it to explode and sink. [Red & bold emphasis added.]

2013 November 18 |

Maine

Change of heart? Maine Gov. convenes climate change group (Nov 15) — Natural Resources Council of Maine, ME

In a letter to DEP Commissioner Patty Aho dated Nov. 5, Gov. LePage writes that "natural resources are the cornerstone of the economies" of many of our coastal and inland communities, and "changes in our climate may provide both opportunities and challenges."

With this in mind, the governor directs Commissioner Aho to convene an "Environmental and Energy Resources Working Group."

"And the purpose of the group is to, basically, create a summary of ongoing projects, programs and/or activities within the natural resource-based agencies," says Adrienne Bennett, a spokesperson for the governor. She says any successful business owner checks inventory from time to time, and this working group is an outgrowth of that idea.

Pete Didisheim, of the Natural Resources Council of Maine, points out that the governor wouldn't have had to establish a working group to develop a coordinated response from state agencies if he hadn't already abolished the Land and Water Resources Council as part of an effort to dismantle the State Planning Office, which did the exact same thing. [Red & bold emphasis added.]

Webmaster's comment: It is unclear at this moment whether or not this will involve the impact LNG would have on Maine and world climate.

Northeast

EIA pegs Marcellus gas production at nearly 13 Bcf/d in December (Nov 8) — Natural Gas Intelligence

Natural gas production in the Marcellus Shale continues to surge higher, with 12.9 Bcf/d expected to come out of the prolific play in December, a 3.3% increase from 12.5 Bcf/d in November, according to EIA's second Drilling Productivity Report (DPR) for key tight oil and shale gas regions.

"And they also do a similar comparison with how productive wells are...essentially, how serious are the decline rates of these wells? And one of the surprises is when you look at it in places like the Marcellus, legacy gas production actually went up this year over last year, presumably because there are more older wells now in existence. But the bottom line is that these wells are not declining perhaps as rapidly as some people thought they would." [Red & bold emphasis added.]

Gulf of Mexico

Latest approval for exporting US LNG a disappointment: Freeport CEO — Platts

The US Department of Energy's latest conditional approval allowing Freeport LNG to ship more liquefied natural gas from its proposed Texas terminal falls 1 Bcf/d short of the Houston-based company's export plans, creating excess capacity and potentially complicating future expansion, the company's CEO said Monday.

The order, just the fifth of its kind DOE has granted, was the second Freeport had received. In May, the agency gave Freeport conditional approval to export up to 1.4 Bcf/d of LNG to non-FTA countries.

Following Friday's Freeport announcement, there are at least 20 non-FTA export applications in line waiting for DOE approval, but Smith said that likely only one more, Sempra LNG's application to ship 1.7 Bcf/d from its Cameron LNG facility in Louisiana, will likely be approved before the DOE imposes a moratorium on new approvals. DOE will likely wait to study new, year-end data before its next approval.

Canada

US energy boom will not result in isolationism, says Ernest Moniz — MoneyControl.com

[This article also appears under the United States heading, below.]

Ernest Moniz said the possibility of the US and Canada together soon producing as much energy as they consume was "a real one".

The shale revolution, unlocking oil and gas from reserves that were not previously commercially viable, has transformed US energy production.

United States

US energy boom will not result in isolationism, says Ernest Moniz — MoneyControl.com

[This article also appears under the Canada heading, above.]

Ernest Moniz said the possibility of the US and Canada together soon producing as much energy as they consume was "a real one".

The shale revolution, unlocking oil and gas from reserves that were not previously commercially viable, has transformed US energy production.

Middle East

Eight Yemeni policemen killed near gas export facility — Reuters

Eight policemen were killed in an ambush by suspected al Qaeda members near a gas export facility in southern Yemen on Monday, residents said.

The attack occurred near an army checkpoint close to the Belhaf gas export terminal, which loads liquefied natural gas (LNG) to South Korea, Yemen's biggest customer, and to European companies. Attacks on pipelines feeding the port have been regular and interrupted exports earlier this year.

2013 November 14 |

Northeast

EIA: Northeast reliance on natgas for power generation 'has raised concerns' (Nov 12) — Natural Gas Intelligence [Subscription]

Relatively low natural gas prices and regional environmental initiatives are leading natural gas-fired generators to provide a greater portion of the electricity in the northeastern United States, and the region's two regional transmission organizations -- the Independent System Operator of New England (ISO New England) and the New York Independent System Operator -- have seen a dramatic shift away from petroleum- and coal-fired generation since 2001, according to the U.S. Energy Information Administration (EIA).

Because New England has "vigorously endorsed a cleaner environment," the region has become "heavily reliant on natural gas," according to ISO New England (see Daily GPI, May 17). Unfortunately, it has limited pipeline capacity -- five gas pipelines and two liquefied natural gas (LNG) storage facilities -- to serve power generators.

Reliability and peak demand in New England could be compromised without a more robust natural gas market and infrastructure build out in the region, according to officials from the gas and power sectors, including Kevin Kirby, vice president for market operations at ISO New England (see Daily GPI,Oct. 24). And Peter Brandien, vice president of system operations for ISO-New England, has said that while New England is taking a fuel-neutral approach, it needs to have additional gas infrastructure (see Daily GPI, Oct. 17).

Energy efficiency programs will help to keep electric demand in the region nearly flat over the next decade, according to ISO New England's 2013 Regional System Plan(see Daily GPI, Nov. 11). [Red & bold emphasis added.]

Webmaster's comment: The most logical, reliable, safe, and economic long-term solution for increasing natutral gas supply in New England and Maine is pipeline infrastructure improvement — not importing expensive LNG from overseas.

British Columbia

Clark: LNG plant will do world a favour — Castanet.net, BC

Premier Christy Clark is calling British Columbia's proposed liquefied natural-gas plants worldwide pollution-fighting machines despite concerns by climate scientists and environmental groups that they will belch millions of tonnes of harmful greenhouse gas emissions into the sky. [Red & bold emphasis added.]

"We are doing the world a favour," she said. [Brown, red & bold emphasis added.]

United States

Gas exports could put nation in ‘danger zone’, trade group tells Moniz — Fuel Fix

HOUSTON — Exports of U.S. liquefied natural gas could drive the country into “a danger zone” in which higher natural gas prices for consumers and manufacturers drag down economic growth, a trade association said in a recent letter to Secretary of Energy Ernest Moniz.

“It is very clear that the cumulative impact of these LNG export approvals has, in fact, undermined the public interest,” said America’s Energy Advantage, which represents manufacturers and public natural gas distribution companies, in its Nov. 8 letter.

Webmaster's comment: Exporting US natural gas now reduces future domestic natural gas supply.

World

LNG 101: Terminals: Operating & under construction — Alaska Journal of Commerce, AK

As of October 2013, there are 32 on-stream LNG liquefaction plants in the world, with 13 under construction and 17 others planned. There are 96 on-stream regasification terminals, with 18 under construction and 25 others planned.

The global list of regasification terminals in the planning stage has shrunk from an all-time high of 47 to 25 in the last year, as several potential projects have either been suspended or canceled. Liquefaction plants in the planning stage were reduced from 21 to 17 in the same time period.

The United States has 11 on-stream regasification terminals with none currently under construction and only two in the planning phase. Eleven U.S. projects that were in the planning phase have either been canceled or suspended.

Webmaster's comment: In 2005 there were 40 LNG import terminal proposals in the US, alone. Now, Downeast LNG stands as the last shoreside import-only holdout proposal left in the US, with no hope whatsoever of succeeding, continuing to throw $millions down a bottomless pit — while needlessly costing US taxpayers for the permitting process.

2013 November 13 |

Northeast

Three Mile Island nuclear plant listed among "most vulnerable" to closure in U.S. (Nov 12) — Lancaster Online, Lancaster, PA

The Three Mile Island nuclear plant has made another list of U.S. nuclear facilities vulnerable to being closed.

And plentiful Marcellus Shale natural gas in Pennsylvania is cited as a prime reason. [Red & bold emphasis added.]

Exporting natural gas is a bad deal for Maryland [Commentary] (Nov 12) — The Baltimore Sun, Baltimore, MD

If you work for the natural-gas industry, own a business involved directly or indirectly with natural-gas production or exports, or own gas reserves, the higher prices that would come from LNG exports would mean higher profits. But as the U.S. economy slowly recovers from the worst economic downturn since the Great Depression, do we really need to increase energy costs to enrich an industry that made $69.3 billion in sales last year?

The DOE data shows that households that rely on income from wages and government transfers — i.e., low and middle income families — will be particularly hard hit. That is because expanding LNG exports "raises energy costs and, in the process, depresses both real wages and the return on capital in all other industries" outside the natural gas supply chain. [Red & bold emphasis added.]

2013 November 11 |

Northeast

USA: FERC vacates order authorizing AES Sparrows Point LNG project — LNG World News

The Federal Energy Regulatory Commission (FERC) issued an order vacating authority granted in 2009 [Dec 17] to AES Sparrows Point LNG and Mid-Atlantic Express to site, construct, and operate a liquefied natural gas marine import terminal and associated facilities in Baltimore County, Maryland.

Webmaster's comment: Another already-permitted LNG import project in the Norhteast bites the dust due to prolific domestic natural gas resources.

2013 November 9 |

Nova Scotia

LNG plan would use pipeline (Nov 8) — The Chronicle Herald, Halifax, NS

Application: Goldboro project eyes Maritimes & Northeast, offshore, shale sources

Developers of an $8.3-billion liquefied natural gas project in Goldboro, Guysborough County, are planning to source part of their supply from New England via the Maritimes & Northeast pipeline.

The rest would come from offshore projects in Nova Scotia and Newfoundland, and at least one-third of its fuel supply would be from shale gas projects in New Brunswick, Pieridae Energy Canada Ltd. said in its licence application to the National Energy Board, filed on Wednesday.

There are plans to reverse the flow and increase overall capacity of the 1,101-kilometre pipeline, which runs from Goldboro to Dracut, Mass., and is a joint venture of Spectra Energy, Emera Inc. and ExxonMobil.

“But reversing M&NP is not the issue; securing additional supplies into (the) U.S. Northeast that can reach M&NP (through pipeline interconnections) is the challenge.” [Red emphasis added.]

Caribbean

10 armed pirates hijack tanker off Malaysia (Nov 8) — The Maritime Executive

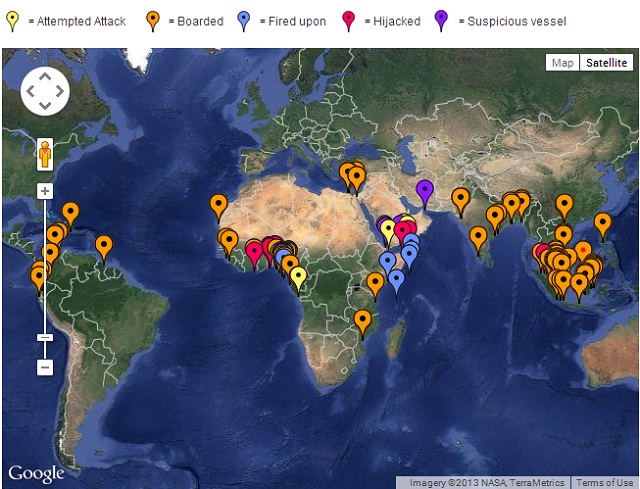

Photo: Live Piracy Map, as of [Nov 8].

Webmaster's comment: The Caribbean and northern South America have active piracy. ICC Commercial Crime Services provides an updated piracy map for 2013.

2013 November 8 |

Northeast

Other opinion: Natural gas industry Why burn taxpayers to aid rich drillers? (Nov 7) — The Times Leader, Wilkes-Barre, PA

Pennsylvania legislators should think long and hard about making taxpayers spend even more money on incentives for natural gas drillers. Drilling companies are making money hand over fist tapping into Pennsylvania’s gas-rich Marcellus Shale deposit. Public money shouldn’t be necessary.

About $30 million is funding such projects, but only a fifth of that amount is coming from a $200 million-a-year drilling fee on the industry. Meanwhile, state officials may tap taxpayers for as much as $1 billion over 25 years to encourage Royal Dutch Shell PLC to build a petrochemical refinery near Pittsburgh.

Taxpayers shouldn’t have to subsidize the the gas drilling companies. Let the free market work.

British Columbia

B.C. government not releasing report measuring LNG’s impact on environment — The Globe and Mail, Toronto, ON

The B.C. government is sitting on a report commissioned by its climate-action secretariat that measures the greenhouse-gas emissions associated with developing a liquefied natural-gas industry.But [B.C. premier Christy Clark] set the bar high when she repeatedly promised that B.C. would produce “the cleanest LNG in the world.”

By the year 2020, British Columbia must reduce its greenhouse-gas emissions by at least 33 per cent below 2007 levels. The target was a central plank in [former premier Gordon Campbell's] commitment to fight climate change. A year ago, Ms. Clark suggested those GHG targets may be bent to clear the way for LNG: “We’ll have to see what happens with some of those targets. We may start thinking more globally about this as a result of it.” [Red & bold emphasis added.]

United States

Group calls for change to US policy on revoking LNG export permits (Nov 7) — Platts

A US industrial energy consumer group on Thursday called the Department of Energy's plan to revoke liquefied natural gas export permits under only extreme circumstances as an "anti-manufacturing" policy that unfairly benefits gas producers and exporters at the expense of US consumers.

"We do not believe that LNG export facilities should have greater investment protection than the domestic manufacturing sector, and we respectfully request a full review of this policy," Paul Cicio, the group's president, wrote to Moniz. "This is a process that benefits those who produce and export natural gas, who have the financial means to spend millions of dollars to produce numerous studies and hire very expensive law firms. We would have hoped the DOE would play the role of public defender and consumer advocate, but that is not the case." [Red & bold emphasis added.]

World

LNG 101: Regasification process and terminals (Nov 7) — Alaska Journal of Commerce, AK

[This is the fifth of a 10-part series about LNG by the Alaska Support Industry Alliance.]

Liquefied natural gas is received and offloaded from an LNG carrier into storage tanks ranging in capacity from 100,000 to 160,000 cubic meters. These maintain the gas in the liquid state at minus-163° Celsius.

Regasification involves gradually re-warming the liquefied gas until its temperature rises above 0° Celsius. The process takes place at high pressure through a series of evaporators, the most energy-efficient technique when the right water quality is available. In other cases, some of the gas is burned to provide the necessary heat. The gas returns to its original state. In other words, it recovers its gas form and its initial volume, almost 600 times greater.

On its way out of the terminal, the gas is treated as necessary to meet the specifications of regulators and end-users. For example, its heating value can be modified by adjusting the concentrations of nitrogen, butane or propane or by blending with other gases.

The gas is then injected into a gas pipeline connected to a distribution network and, in this way, it reaches the end user, whether household or industrial.

2013 November 6 |

Nova Scotia

Goldboro LNG files environmental report — Guysborough Journal, Guysborough, NS

Pieridae Energy has filed the environmental assessment report for its Goldboro LNG project with the provincial Dept. of Environment. The filing starts the clock ticking for the 110-day deadline for the Minister of Environment to make a decision on an environmental permit.

Describing the filing of the environmental assessment report as a “major milestone”, Mark Brown, Pieridae’s director of project development, told The Journal on Monday that the department’s review panel will decide whether a public hearing will take place, after the period for comments expires.

In addition to the approval of the project under the NS Environmental Assessment Regulations, a number of federal and provincial environmental approvals and permits will be required. In particular, the marine terminal will require an approval under the Navigable Waters Protection Act (NWPA). The federal Fisheries Act is expected to require an authorization for work involving marine and freshwater fish habitat.

Webmaster's comment: Pieridae Energy (Goldboro LNG) has previously indicated it is planning to source natural gas from the United States via the Martimes and Northeast Pipeline. That would require reversing direction of the pipeline; thus, sending natural gas from New England, through Maine, to Nova Scotia — in direct conflict with Downeast LNG's plans to send it's imported LNG-sourced natural gas south.

Perhaps Goldboro LNG is planning to sell its LNG to Downeast LNG, so they can keep busy sending each other the same natural gas and LNG!

Northeast

Officials ‘stop clock’ on Port Ambrose application (Nov 7) — Independent, Manalapan NJ

Citing a significant amount of missing information and delays caused by the recent government shutdown, federal officials will “stop the clock” on the processing of Liberty Natural Gas (LNG)’s Port Ambrose application for 90 days.

In a letter sent to LNG on Oct. 21, U.S. Coast Guard representatives said they have found more than 250 “data gaps” in the company’s application to build a deepwater natural gas port off the coast of New Jersey and New York.

“Under the law, Liberty was supposed to do a thorough assessment of how this project fits with New Jersey’s coastal zone management program, but they didn’t do so,” said Sean Dixon, coastal policy attorney for the nonprofit Clean Ocean Action.

Webmaster's comment: In other words, data submission deadlines are not deadlines, at all.

Direct concerns about LNG facility to FERC, federal officials — SoMdNews.com, MD

The decision to turn the Dominion Cove Point Liquefied Natural Gas facility into an import and export depot has certainly become a topic of much debate in recent weeks as Dominion has inched closer to receiving Federal Energy Regulatory Commission approval to start the necessary construction on the facility to allow LNG exporting. The current facility only imports LNG, but plans are in the works to construct equipment that will allow Dominion to liquefy natural gas for export.

In recent weeks, there have been two instances where the opponents have come out to public events to speak about their concerns. One was a well-attended town hall meeting, dubbed “Calvert at Risk,” which was hosted by the Chesapeake Climate Action Committee Director Mike Tidwell, Patuxent Riverkeeper CEO Fred Tutman, Earthjustice attorney Moneen Nasmith and Cove of Calvert Homeowner’s Association member Jean Marie Neal. They addressed concerns about the noise pollution the new equipment would produce, the number of import and export ships the facility would see in a year, the increased traffic construction at the facility would bring to the area and the tons of carbon dioxide the facility would emit once completed.

Cove Point controversy continues (Nov 4) — The Bay Net, Hollywood, MD

“The expansion would allow the company to export liquefied natural gas,” a joint memo from Department of Economic Development Director Linda Vassallo, Department of Finance and Budget Director Tim Hayden and County Attorney John Norris stated. “Dominion originally requested a 50 percent tax credit for 10 years. The proposed PILOT and tax agreement will be in place for 15 years.”

The anti-expansion entourage will be wending their way across the state in a caravan of decorated hybrid vehicles. A CCAN press release stated the speakers “will educate the public about the risks of drilling, piping and liquefying ‘fracked’ gas for export when real clean-energy alternatives exist.”

United States

USA: Six LNG cargoes imported in Sep (Nov 5) — LNG World News

The Everett LNG terminal received two cargoes while the Sabine Pass, Freeport, Cove Point and the Elba Island terminal received one cargo each.

2013 November 1 |

Nova Scotia & New Brunswick

LNG proponent eyes more clients (Oct 31) — The Chronicle Herald, Halifax, NS

Pieridae, which recently filed an environmental assessment for the project with the province, is planning an LNG plant and export terminal that will handle up to 10 million tonnes of gas per year.

Pieridae is looking at several potential sources, including U.S. shale gas and offshore and onshore resources in Atlantic Canada, all of which would be brought to the facility via pipeline.

There is also speculation that Spanish energy firm Repsol SA could turn its Canaport LNG import facility in Saint John, N.B., into an export operation. [Red, yellow & bold emphasis added.]

Goldboro LNG megaproject under environmental review (Oct 31) — CBC News

Calgary developer Alfred Sorensen says the Goldboro LNG plant will be larger than the Canaport LNG terminal in Saint John, N.B.

A German electrical utility has signed on as a customer, but the project needs to secure natural gas and is eyeing supply from the United States.

Construction could begin in two years if Pieridae can sign a contract for American shale gas, and get the go-ahead from the province. [Red, yellow & bold emphasis added.]

Goldboro LNG submits Environmental Assessment Report (Canada) (Oct 30) — LNG World News

Pieridae Energy said that the Environmental Assessment report for the proposed Goldboro LNG project has been submitted to Nova Scotia Environment. The report was completed after much consultation with local communities, government agencies, and engagement with First Nation communities.

Maine

Industry reps discuss the future of petroleum use in Maine — Natural Resources Council of Maine

The Debate Over Natural Gas in Maine

In Maine it was an alliance of various industrial interests that helped pass the Legislature's so-called "omnibus energy bill," which allows the Public Utilities Commission (PUC), with approval from the governor, to collect fees from ratepayers to buy up to $75 million annually in natural gas pipeline capacity, with the goal of spurring private investment in new pipelines into the state. This was a move that groups like the Maine Energy Marketers (MEMA) adamantly opposed. [Red & bold emphasis added.]

Webmaster's comment: The omnibus energy bill eliminates any hopes Downeast LNG may have had for state support for its doomed LNG import project.

As natural gas companies snatch up customers, oil providers offer ways to reduce bills (Oct 30) — Bangor Daily News, Bangor, ME

“We’re on track to put in about 800 new services this year,” Andrew Barrowman, manager of sales and marketing for Bangor Natural Gas, said Wednesday.

The company is providing natural gas to 4,156 customers in Bangor, Brewer, Orono, Old Town Veazie and Bucksport, with about 275 more to be added before installations wind down by December.

Bangor Natural Gas has set a goal of bringing 5,000 customers online by 2014 and doubling that amount by 2017, Barrowman said. The company is working to extend a gas line to Lincoln and will continue to spread through Bangor’s surrounding communities, he said.

“We’ve stopped taking customer applications for installing gas this year,” he said, adding that they’re still accepting applications for spring hookups. A Bangor Gas expansion into Lincoln is expected to bring more customers after the company taps into the 190-mile Loring pipeline, which runs from the Mack Point port facility in Searsport to the former Loring Air Force Base in Limestone.

…The company has services in Gorham, Freeport, Pownal, Brunswick, Topsham, West Bath and Bath, and recently expanded to Augusta after finishing a 21.4-mile connection from the Maritimes and Northeast Pipeline, which stretches from Atlantic Canada to Massachusetts, to the state’s capital city. The new extension will provide natural gas to the new Maine General Hospital and allows for service to other Augusta customers… [Red & bold emphasis added.]

Maine Natural Gas completes Augusta pipeline, will start gas deliveries (Oct 25) — Mainebiz

Maine Natural Gas, which is in heated competition with Summit Natural Gas to provide natural gas to the Augusta area, said Thursday that it has finished filling its 21.4 mile steel and plastic natural gas main, and expects to deliver gas to its first customers this week.

That line runs from the Maritimes and Northeast pipeline tap in Windsor through Augusta to the new regional hospital at the MaineGeneral Medical Center. Maine Natural Gas, headquartered in Brunswick, is a subsidiary of Iberdrola USA, which also owns Central Maine Power Co. [Red & bold emphasis added.]

New England

EIA: Marcellus gas pipeline projects to primarily benefit New York and New Jersey (Oct 31) — LNG World News

[This same article appears under the Northeast heading, below.]

Multiple pipeline expansion projects are expected to begin service this winter to increase natural gas takeaway capacity from the Appalachian Basin’s Marcellus Shale play, where production has increased significantly over the past two years. These new projects are largely focused on transporting gas to the New York/New Jersey and Mid-Atlantic regions and would have limited benefit for consumers in New England, where price spikes during periods of peak winter demand appear likely to persist.

New England consumers, however, would not significantly benefit from currently planned pipeline expansions until 2016. The Algonquin Gas Transmission (AGT) pipeline, which takes gas from Marcellus and other sources to consumers in New England, has traditionally operated at near-full capacity during periods of peak winter demand. The next planned expansion on AGT is the Algonquin Incremental Market (AIM) project, which would enable the pipeline to flow north an additional 0.42 Bcf/d of gas received at its interconnect with Millennium Pipeline in Ramapo, New York. The target in-service date for the AIM Project is November 1, 2016. [Red, yellow & bold emphasis added.]

Webmaster's comment: This is Downeast LNG's worst nightmare!

Northeast

Coast Guard halts LNG port application over enviro concerns — Law 360 [Subscription]

Federal officials have put a 90-day hold on processing the license application for Liberty Natural Gas LLC's proposed Port Ambrose liquefied natural gas deepwater port off the New York and New Jersey coasts, according to a letter made available Wednesday, saying it needs more time to vet the project's environmental impact.

The U.S. Coast Guard notified Liberty Natural Gas on Oct. 21 that the 90-day suspension is needed to allow the Coast Guard and the U.S. Maritime Administration ample time to address "data gaps" needed to... [Red & bold emphasis added.]

How low will gas prices go after winter forecasts warm? (Oct 31) — Energy Spotlight Broadcast, Platts

US natural gas traders turned bearish after winter forecasts flipped from colder to warmer over the weekend. Not helping matters is oversupply, now a glut, with more Utica gas coming to market while the Marcellus keeps growing: the Beast in the East. [Red & bold emphasis added.]

Webmaster's comment: Domestic natural gas supply in the Northeast keeps shoving Downeast LNG's nose in the dirt.

USA: Spectra Energy completes New Jersey–New York gas pipeline — LNG World News

Spectra Energy Corp today announced the successful completion of its New Jersey – New York Expansion Project. The new pipeline, an extension of Spectra Energy’s Texas Eastern and Algonquin Gas systems, is designed to bring customers in the region 800 million cubic feet per day (mmcf/d) of natural gas supplies, as well as economic and environmental benefits.

“Successfully completing this pipeline is a testament to our ability to secure, permit and execute on large and complex growth projects,” said Greg Ebel, president and chief executive officer, Spectra Energy. “We’ve built the first natural gas pipeline into Manhattan in more than 40 years, one that will supply the region with safe, affordable, clean, domestic natural gas. Completing this pipeline is a great accomplishment, and one in which our team can take great pride.” [Red & bold emphasis added.]

Webmaster's comment: Downeast LNG wants the public to believe this is impossible.

EIA: Marcellus gas pipeline projects to primarily benefit New York and New Jersey (Oct 31) — LNG World News

[This same article appears under the New England heading, above.]

Multiple pipeline expansion projects are expected to begin service this winter to increase natural gas takeaway capacity from the Appalachian Basin’s Marcellus Shale play, where production has increased significantly over the past two years. These new projects are largely focused on transporting gas to the New York/New Jersey and Mid-Atlantic regions and would have limited benefit for consumers in New England, where price spikes during periods of peak winter demand appear likely to persist.

New England consumers, however, would not significantly benefit from currently planned pipeline expansions until 2016. The Algonquin Gas Transmission (AGT) pipeline, which takes gas from Marcellus and other sources to consumers in New England, has traditionally operated at near-full capacity during periods of peak winter demand. The next planned expansion on AGT is the Algonquin Incremental Market (AIM) project, which would enable the pipeline to flow north an additional 0.42 Bcf/d of gas received at its interconnect with Millennium Pipeline in Ramapo, New York. The target in-service date for the AIM Project is November 1, 2016. [Red, yellow & bold emphasis added.]

Webmaster's comment: This is Downeast LNG's worst nightmare!

Marcellus Shale gas growing faster than expected (Oct 29) — (AP) The Akron Legal News, Akron, OH

Marcellus production has now reached 12 billion cubic feet a day, the Energy Information Administration report found. That's the energy equivalent of about 2 million barrels of oil a day, and more than six times the 2009 production rate.

For perspective, if the Marcellus Shale region were a country, its natural gas production would rank eighth in the world. The Marcellus now produces more natural gas than Saudi Arabia, and that glut has led to wholesale prices here that are about one-quarter of those in Japan, for example. [Red & bold emphasis added.]

20 Bcf per well: New operating standard in the Marcellus Shale? (Oct 27) — Seeking Alpha

Reporting its third quarter results, Cabot Oil & Gas (COG) delivered a fresh crop of "monster" Marcellus wells that further reinforce the productivity and consistency of the play's dry gas sweet spot in Northeast Pennsylvania. The results for the quarter also highlight a steady trend towards higher EURs [Estimated Ultimate Recovery] per well.

What is the break-even natural gas price for a 20 Bcf well? The question is almost irrelevant. These wells are arguably the most economic natural gas wells, including both dry gas and liquids-rich gas plays, and therefore will be drilled irrespective of natural gas prices, as long as take-off capacity exists. [Red & bold emphasis added.]

EIA: Better drilling, bigger wells driving Marcellus growth despite fewer rigs (Oct 24) — StateImpact Pennsylvania, PA

In the first of what will be a monthly report on drilling productivity, the U.S. Energy Information Administration noted this week that “new technologies for drilling and producing natural gas and oil have made traditional measures of productivity, such as a simple count of active rotary drilling rigs, obsolete.” So the agency is using different measures to record productivity, especially an estimate of how much gas or oil is produced from new wells in a month per average rig operating in the region. The estimate indicates both the time it takes to drill a well and the well’s production, the agency said.

The report held surprises for energy experts who did not expect the Marcellus Shale to reach its current output of more than 12 billion cubic feet of natural gas per day this year, or even for several years.

Dominion LNG project concerns abound for Calvert residents (Oct 25) — South Maryland Newspapers Online, MD

At the “Calvert at Risk” town hall meeting, residents heard about the proposed Dominion Cove Point Liquefied Natural Gas exportation project from Chesapeake Climate Action Committee Director Mike Tidwell, Patuxent Riverkeeper CEO Fred Tutman, Earthjustice associate attorney Moneen Nasmith, and Cove of Calvert Homeowner’s Association member Jean Marie Neal.

At Tuesday’s meeting, the panelists agreed the major concern with the proposed project is that a comprehensive environmental impact study is not yet proposed and that Dominion is claiming it isn’t necessary.

Nasmith said, “FERC has already decided they aren’t going to do an environmental impact study. ... They’ve completely ignored the fact that they may need to do an environmental impact study.”

FERC is analyzing information from Dominion, the application and supplemental correspondence and is preparing an environmental assessment, according to an Oct. 18 project review update. FERC also is analyzing information other commentators have filed, the notice states.

Following the release of the assessment, there will be a 30-day public comment period, and then the recommendations will be presented to the commission for a decision.

US Atlantic Coast

U.S. considers Atlantic reserve potential (Oct 30) — UPI

WASHINGTON, Oct. 30 (UPI) -- The U.S. government doesn't necessarily need a full set of data on the reserve potential in the Atlantic basin to consider a lease sale, a director said.

Tommy Beaudreau, director of the U.S. Interior Department's Bureau of Ocean Energy Management, said his agency should have enough information on hand to consider the east coast for a five-year lease plan beginning in 2017.

"We have a strategy for evaluating whether and, if so, under what configuration to have sales, but not all of that has to come together before you start scoping the next five year plan, which we're going to start in 2014," Beaudreau said. [Brown & bold emphasis added.]

Canada

Pipeline safety incident rate doubled in past decade — CBC News

Database gives detailed picture of 1,047 reported problems

The pipeline industry has touted its record as it seeks support for numerous controversial projects across the continent, including TransCanada’s Keystone XL to the U.S. Gulf Coast and Enbridge’s Northern Gateway to the B.C. coast.

However, according to figures from a National Energy Board (NEB) data set obtained under access-to-information by CBC, the rate of overall pipeline incidents has doubled since 2000.

Among the other findings based on NEB’s pipeline database is that there’s been a three-fold increase in the rate of product releases — ranging from small leaks and spills to large — that have been reported in the past decade.

More than four reportable releases happened for every 10,000 kilometres in 2000, or 18 incidents in total, according to NEB data. By 2011, that rate had risen to 13 per 10,000 kilometres, or 94 incidents. [Red & bold emphasis added.]